CC-Submit

In affiliate marketing, understanding the payment flow behind an offer is key to choosing the right campaigns and traffic strategies. One term you’ll often encounter — especially in high-payout verticals like nutra, adult, and sweepstakes — is cc-submit, short for credit card submit.

So, what is cc-submit?

It means a conversion where the user has to submit valid credit card information — usually on a checkout or signup page — as the final step before a conversion is counted. This happens after a user has interacted with a pre-landing or a sales page, and is considered one of the most valuable and committed conversion types in affiliate marketing.

CC-submit offers are closely tied to online transactions, secure payments, and affiliate payments that go through verified payment gateways. Because the user shares sensitive financial data, such offers generally imply high trust, legal compliance and technical precision on both the advertiser’s and affiliate’s side.

In this article we’ll cover everything:

- A precise cc-submit definition

- How this conversion flow works

- What verticals use it

- Benefits and risks

Whether you’re new to cc-submit affiliate marketing or looking to improve your current campaigns, this article has got you covered with up-to-date information for 2025 and beyond.

CC-Submit Definition: What Does It Really Mean?

The term cc-submit, short for credit card submit, is a conversion model in affiliate marketing where a lead is counted only after the user enters their credit card information into a form, usually during a purchase or trial sign-up. Unlike simpler actions like SOI (single opt-in) or DOI (double opt-in), cc-submit requires an actual payment attempt, even if it’s just $1 for a trial.

In other words, this is not just about collecting emails or user data — it’s about collecting validated billing information through a secure payment gateway, which often involves:

- Credit card number

- Expiry date

- CVV code

- Billing address

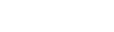

Because of the user’s financial commitment, cc-submit affiliate marketing offers tend to pay much higher than CPL (cost per lead) or CPA (cost per action) models where no payment is required. This model is especially popular in high-risk, high-reward verticals such as, for example:

- Nutra: Weight loss, skincare, male enhancement trials (often trial-to-rebill)

- Adult: Premium memberships or pay-per-view access

- Sweepstakes: Prize draws that require small entry fees via card

- Streaming & VOD: Trial access to movies or shows behind a paywall

- Finance: Credit score checkers, trial-based fintech tools

- iGaming: Some regulated markets may use cc-submit as entry point

These offers are tracked using postback URLs with payment confirmation from the merchant’s processor, so only verified online transactions count as conversions.

💡 Quick Summary:

The cc-submit means the user submits their credit card details to trigger a conversion. It’s a high-barrier conversion model that generates secure payments for the advertiser and high commissions for the affiliate.

How CC-Submit Works: From Click to Conversion

If you’re going to run affiliate campaigns with this payout model, you need to understand how cc-submit works. Unlike SOI or DOI offers where user engagement ends with a form submission, cc-submit requires the user to go through multiple deliberate steps and enter payment details — which increases commitment but also boosts conversion value.

Let’s break it down.

The Typical CC-Submit Funnel

Here’s what the user journey looks like in a classic cc-submit funnel:

| Step | Description | Key Element |

| 1. Click | User clicks on an ad (push, pop, native, etc.) | Traffic source |

| 2. Pre-Landing | An intermediate page that builds interest and filters users | CTA, reviews, urgency |

| 3. Offer Page | The main product or subscription page | Product info, benefits |

| 4. CC Form | User submits their credit card info | Payment gateway integration |

| 5. Conversion | If billing is successful, the affiliate is paid | Postback fires |

Involvement of Payment Gateways

The offer page is connected to a payment gateway — like Stripe, CCBill or specialized processors for trial or adult offers. These systems ensure PCI compliance, secure encryption and fraud prevention.

This is where secure payments matter most: user data must be protected and conversions only count if the transaction is authorized.

Trial vs. Straight Sale

There are two types of cc-submit models:

- Trial Offers: User pays a small fee ($1-$5) for a limited trial; upsells or rebills follow.

- Straight Sale: Full payment upfront; no trial period.

Each has its pros and cons. Trial offers convert better due to the low barrier but can result in more chargebacks or disputes. Straight sales offer cleaner data and are less risky in that regard.

⚠️ Important to Know:

- If user enters invalid payment info, the conversion doesn’t count

- Some offers may pre-authorize without charging initially

- Many affiliate networks require pre-approval to run cc-submit due to higher fraud risk

Key takeaway:

The cc-submit process has multiple friction points but each filters for high-intent users. That’s why such offers have high EPC (earnings per click) and payout — making them a powerful but advanced option in affiliate marketing.

CC-Submit Payment Method: How Payments Are Handled and Secured

At the heart of every cc-submit affiliate marketing offer is a payment method that involves a real transaction. This isn’t just about user interest — it’s about converting that interest into a secure online payment through a verified payment gateway.

What Happens During a Credit Card Submit?

When a user reaches the checkout or signup page of a cc-submit offer, they are asked to enter their credit card information, which typically includes name, card number, expiration date, CVV, billing address.

Once submitted, this information is sent through a payment gateway like Stripe, CCBill, Verotel, Epoch or other niche processors depending on the offer’s vertical (nutra, adult, gambling etc.). These services handle the affiliate payments on the advertiser’s side and ensure the transaction is authorized, declined or flagged for risk.

Ensuring Secure Payments

CC-submit offers must comply with PCI DSS (Payment Card Industry Data Security Standard) which means all credit card data is transmitted and stored securely. Here’s how platforms ensure secure payments:

- SSL on all form pages

- Tokenization of card data

- Fraud detection tools

- 3DSecure or CAPTCHA for validation

- Geo/IP verification

Without these protocols conversions may be rejected or lead to chargebacks which can damage the advertiser’s merchant account and the affiliate’s trust level.

Risk of Chargebacks and Fraud

While cc-submit offers pay well, they also come with problems:

- High chargeback rates can get offers shut down

- Fraudulent transactions from stolen cards hurt your traffic reputation

- Many geos (like Tier 1 countries) have strict laws around data collection and consumer rights

That’s why you should only work with trusted affiliate networks and payment processors that vet and approve their offers thoroughly.

💡 Tip for Affiliates:

Use clear, honest creatives and reliable pre-landings to build trust before asking users for credit card details. Push and pop traffic can work — but must be high-quality and compliant to avoid penalties or bans.

In short: A cc-submit payment method is more than just a form — it’s a full transaction process involving payment validation, fraud screening and secure data transmission. For affiliates, understanding this flow is key to promoting these offers successfully and ethically.

CC-Submit in Affiliate Marketing: Why It’s a High-Value Model

In affiliate marketing, not all conversions are created equal. While SOI and DOI offers bring in volume, cc-submit affiliate marketing is where the real money is — both for advertisers and publishers.

So, what makes a cc-submit offer stand out? It’s simple: actual payment. Unlike cost-per-lead models, a cc-submit conversion occurs only when a user enters valid credit card details and the online transaction is processed via a payment gateway. This creates a high-barrier, high-reward model that typically pays much better per conversion.

Example EPC Comparison

| Conversion Type | Average Payout | EPC (Estimated) |

| SOI | $1–$2 | $0.10–$0.30 |

| DOI | $3–$6 | $0.30–$0.60 |

| CC-Submit | $30–$100+ | $1.50–$5.00 |

⚠️ Note: EPC will vary based on traffic quality, offer type, and user geo.

Advantages & Disadvantages of CC-Submit Offers

Running cc-submit affiliate marketing campaigns can be very profitable but comes with challenges. To make the right decisions, affiliates need to understand both sides of the coin — why cc-submit works and where to be cautious.

Let’s break it down.

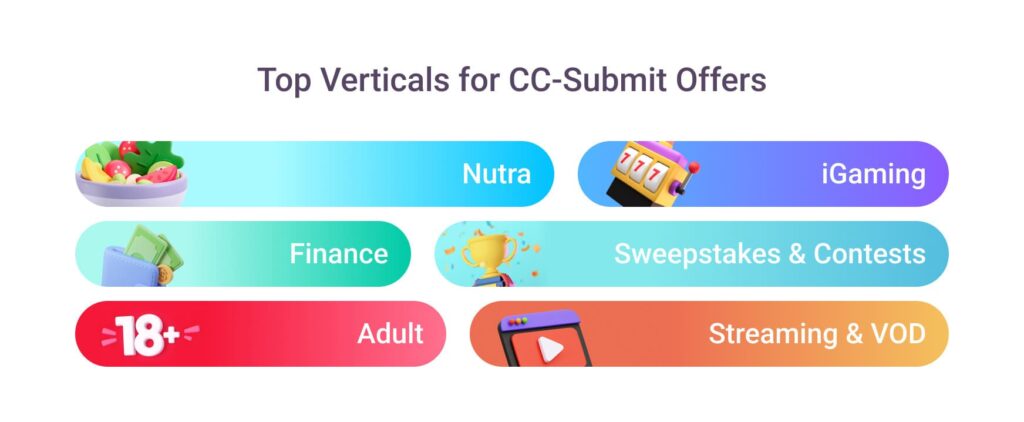

✅ Advantages of CC-Submit

- High Payouts per Conversion

CC-submit offers pay $30–$100+ especially in nutra, adult and finance verticals. These high payouts are very attractive for experienced media buyers. - Higher Quality Leads

Since the user must complete an online transaction with a credit card submit, the barrier to entry is high. This filters out junk traffic and delivers high intent users. - Recurring Revenue Potential

Many cc-submit offers — especially in the subscription or trial space — have rebills. This means more value per lead and long-term affiliate payments. - Premium Advertisers

Most cc-submit offers come from trusted, regulated advertisers who use verified payment gateways, which adds an extra layer of security and payment reliability. - Scalability with Push and Pops

High converting creatives combined with volume traffic sources like push notifications and popunders allow affiliates to scale big.

❌ Disadvantages of CC-Submit

- High Fraud Risk

Because users submit payment info, cc-submit flows are a frequent target for fraud (stolen cards, bots, etc.). That’s why most networks require pre-approval and closely monitor this traffic. - Chargebacks and Refunds

Even real users may dispute charges after seeing rebills. High chargeback rates can lead to offer removal, affiliate bans or payment holds. - Strict Compliance Rules

CC-submit offers must follow secure payment regulations, display terms clearly and ensure billing practices are transparent. Affiliates using misleading copy or fake endorsements risk being banned. - Not Beginner-Friendly

These offers require skilled media buying, compliance awareness and understanding of payment flows. Beginners may struggle to get approved or manage optimization correctly. - Limited Geo Availability

Some cc-submit campaigns are restricted to specific countries due to payment gateway limitations or legal reasons. Affiliates must always check geo targeting rules.

📌 Pro Tip: Before running cc-submit offers make sure your landing pages are clear, compliant and optimized for trust. Transparency equals conversions — and protects your accounts.

Conclusion

CC-submit is a powerful model in affiliate marketing — high payouts, serious user intent and long-term value. But it demands quality traffic, compliance and deep understanding of payment flows and online transactions.

If you’re ready to work with high converting verticals like nutra, finance or adult and can deliver clean traffic through trusted sources, cc-submit can be a game changer.

At ROIads ad network, we work with top tier cc-submit offers and help affiliates succeed with advanced tools, push, in-page push, pop, and direct link traffic with expert support. Looking to scale? This is where it starts.