The finance vertical is one of the most profitable in affiliate marketing. From credit card signups and loan applications to crypto trading platforms and personal finance tools — advertisers are always looking for quality leads with high intent to convert. The challenge? The competition is fierce, and most channels are oversaturated or too expensive.

That’s where popunder ads come in.

Often overlooked, pop traffic has become a goldmine for affiliate marketers promoting finance offers — especially in high-payout geos like the United States. With the right setup, targeting and optimization strategy, popunder traffic can drive thousands of conversions at a fraction of the cost of traditional advertising formats like native or search.

In this guide, we’ll break down how to launch and scale finance ads with popunder traffic in the US market. You’ll learn which finance offers work best, what targeting options bring the most ROI, which pop ad networks to trust and how to structure your funnel for maximum profitability.

Let’s get started.

Why Promote Finance Offers with Popunder Ads

In the crowded world of finance advertising, affiliates are always looking for affordable yet high-converting traffic sources. While formats like native and search are often expensive and require heavy compliance moderation, popunder ads offer a different angle — low competition, high volume and users in a decision-making mindset.

Here’s why pop traffic works so well for promoting finance offers in the US.

1. Users Are Ready to Explore

Pop ads appear behind the main browser window, so users often see the offer once they’ve finished their original task. This creates a distraction-free environment — perfect for finance ads that require more attention like loan applications or trading platform signups.

2. Cost-Efficient Entry Point

Compared to CPC-heavy formats like native or Google Ads, popunder traffic is much cheaper. CPMs for pop ads in the US can start from $0.5-$1.5, so it’s an ideal testing ground for new finance vertical campaigns without blowing your budget.

3. High Volume + Broad Reach

Popunder networks deliver millions of daily impressions across the US market. For affiliates promoting finance offers that rely on volume (like credit score checks or lead gen forms), this traffic type helps scale fast.

4. Behavioral Fit with Finance Offers

Finance products — especially those related to loans, debt relief, crypto and budgeting tools — target users who browse informational or adult content. These audiences are reached via popunder ad networks so the format is naturally aligned with the finance traffic demographic.

5. Minimal Creative Requirements

Unlike push or native, pop ads don’t require banners or ad creatives. Your main focus is on the landing page and pre-landing — so you have full control over message delivery, funnel structure, and compliance without worrying about ad rejections due to creative content.

Roya, Emotional Damage Officer & Supreme AI Arbitragist at ROIads

Finance Vertical Overview in the US

The United States is one of the most competitive yet lucrative markets for finance offers. From credit products and loan services to fintech apps and investment platforms, the demand is huge — but so is the regulation and user skepticism. To succeed, affiliates need to know what types of offers actually work, what users expect and how to match funnel intent with the right traffic source.

Trending Finance Offers in the US Market

Based on 2026 affiliate data, the following finance vertical sub-niches are performing best on popunder traffic in the US.

- Personal Loans – Quick application funnels with soft credit checks.

- Credit Score Monitoring – Lead generation offers with free trials or freemium tools.

- Crypto & Forex Trading – Aggressive payouts, high user value, best for qualified traffic.

- Credit Card Applications – Branded offers via official banks or fintech startups.

- Tax & Budgeting Tools – Seasonally strong offers, especially around Q1–Q2.

These offers usually fall into lead generation (SOI/DOI) or FPA (First Page Submit) models which are ideal for pop traffic due to the format’s simplicity and volume capacity.

Key Characteristics of US Finance Traffic

- High intent but also high expectations — users often compare multiple services before converting.

- Users are privacy-conscious, so landing pages must look trustworthy and secure.

- Many users browse from desktop — especially for trading and credit-related products.

- Conversion delay is common — expect to wait a few hours (or days) before seeing true performance metrics.

📊 Table: Top Finance Offer Types vs. Avg. CR & EPC on US Popunder Traffic

| Offer Type | Avg. CR (%) | EPC ($) | Notes |

| Personal Loans | 8.5% | 1.80 | Broad reach, good for volume |

| Credit Score Checks | 11.2% | 1.10 | Fast conversion, entry-level |

| Crypto/Forex Trading | 4.3% | 2.40 | High payout, best with whitelist |

| Credit Card Signups | 6.7% | 1.60 | Solid ROI, requires clean funnel |

| Tax Tools | 7.9% | 1.30 | Seasonal peaks, high trust need |

Market Snapshot: Finance Vertical in the US (2026)

- $1,126.1 billion – projected size of the global fintech market in 2032.

- 23% – expected growth in ad spend for payments and money movement sectors in 2026, as financial services expand into digital channels.

- 20% — projected increase in advertising investment across banking and lending sectors in 2026.

- $16 billion — estimated affiliate marketing spend in the US by 2028, with the finance vertical ranked among the most profitable sectors.

- $6.50 – average return for every $1 spent on affiliate marketing campaigns in the US, highlighting the high ROI of performance-based traffic models.

How Popunder Traffic Works for Finance Offers

Popunder traffic — also known as pop traffic — is one of the most underutilized yet powerful formats for promoting high-ROI verticals like finance. Instead of showing an ad directly in front of the user, popunder ads open a new browser tab or window behind the active one. This subtle difference changes the user behavior and opens up new opportunities for affiliates promoting finance offers.

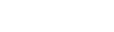

What Makes Popunder Ads Unique?

- Unobtrusive by design: Pop ads appear behind the user’s current browser, so they don’t interrupt the user immediately and give them time to complete their original task before seeing your offer.

- One-view = full exposure: Once the tab is visible, the user sees your entire landing page — not just a banner or short push notification. This makes popunder perfect for finance products that need explanation, trust signals or form fields.

- No creatives required: You don’t need banners or ad copy. The focus is on your landing page, pre-landing, and conversion flow — so you have full control over how the offer is presented.

Why It Works So Well for Finance Ads

Finance products involve commitment and sensitive personal data (credit checks, banking info, investment). With popunder ads, you’re not relying on an aggressive CTA — you’re creating a situation where the user naturally lands on a full-screen environment that convinces them. This works especially great for:

- Lead gen (SOI/DOI, credit score tools, loan requests)

- High-payout finance offers (crypto apps, stock platforms)

- Soft-conversion funnels (calculator tools, tax wizards, budgeting apps)

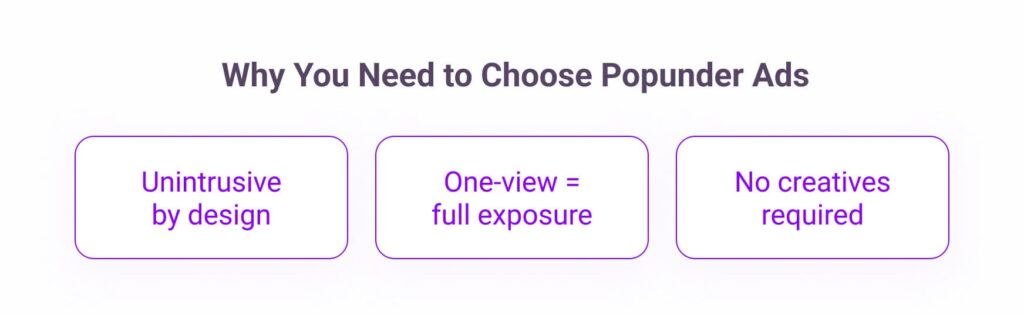

A Typical User Journey with Popunder Traffic

- The user visits a high-traffic website (news, adult, torrent, etc.).

- A popunder ad is triggered and opens in the background.

- After finishing their original activity, the user checks open tabs.

- They discover your finance landing page — often positioned as a helpful solution (e.g., “Check if you qualify for a $5,000 loan”).

- If your page is optimized for trust and clarity, they engage and convert.

This format has high exposure, especially on desktop where users are more likely to browse multiple tabs — a key behavior when promoting complex finance services.

Best Popunder Ad Network for Finance Advertising in the US

When it comes to running finance offers with popunder traffic in the United States, one ad network stands out for affiliates looking for performance, control and scale — ROIads.

Why ROIads Is the Go-To Platform for Finance Pop Campaigns

ROIads is a self-serve ad platform specializing in popunder and push traffic. It combines massive traffic volumes, smart optimization tools and transparent analytics to give affiliates everything they need to succeed in the competitive finance vertical.

Key Advantages for Finance Advertising:

- Premium US Popunder Traffic

ROIads delivers high volumes of clean, real-user premium traffic across placements in the United States. This is especially valuable for finance funnels that require trustworthy user behavior and longer session times. - Micro Bidding for Source-Level Control

You can enable Micro bidding to adjust bids for each traffic source (publisher, site, or zone). This allows you to boost high-performing segments and cut out the noise — a must-have for running ROI-positive finance campaigns. - Smart Segmentation

Segment your pop traffic by geo, device type, OS, browser and connection. For the finance vertical, this means you can target desktop Chrome users in high-income states — and exclude low-engagement sources. - AI Bidding Technology

The smart algorithm automatically optimizes traffic sources in real time to reach the best possible ROI. AI Bidding strategy is enabled by default for all new ca,paigns in ROIads. - Conversion-Based Optimization

ROIads supports postback tracking and integration with popular trackers (Voluum, Keitaro, RedTrack, BeMob, CPV Lab Pro). This is crucial for analyzing lead quality and optimizing your finance campaigns based on real performance data. - Dedicated Account Support

Deposits of $500+ come with a personal manager who helps you build custom whitelists, blacklist low-converting sources and get free creatives if needed — a big plus when testing new finance offers.

ROIads Quick Facts for Finance Affiliates

| Feature | Details |

| Traffic Format | Popunder (and Push) |

| Minimum Deposit | $250 |

| Top Geos for Finance | United States, Germany, India, Brazil |

| Daily Impressions | Over 900 million |

| Optimization Tools | Micro bidding, AI bidding technology, CPA Goal, Optimization rules |

| Integration | Voluum, BeMob, Keitaro, RedTrack, CPV Lab Pro |

| Support | Dedicated manager for $500+ deposit accounts |

Targeting Tips for Finance Ads on Pop Traffic in the US

Finance is one of those verticals where targeting is everything — especially on popunder traffic. Since the format gives you massive reach and doesn’t rely on creatives, your main edge comes from who you’re targeting and how you optimize.

Below are the best targeting strategies for running finance ads on popunder traffic in the US:

1. Geotargeting

United States only — but go deeper: you can target high-income states like California, Texas, Florida, New York.

2. Device Targeting

Desktop traffic outperforms mobile in the finance vertical:

- Users fill out forms more easily.

- Longer attention span = better for complex offers (loans, trading, crypto).

- Many financial tools and dashboards are desktop-optimized.

3. Browser & OS Targeting

- Chrome and Windows users convert more.

- Exclude outdated browsers like Internet Explorer.

Test macOS separately — it often performs well for fintech and investment offers.

4. Time Targeting

- Best performance is seen on weekdays (Mon–Thu) between 9 AM – 6 PM, when users are in research or application mode.

- Weekends can still work for tools like credit score checks or budget apps.

5. Frequency & Cap Settings

- Limit frequency to 1–2 popunders per user per day to avoid banner blindness.

Creative & Funnel Recommendations for Finance Popunder Ads

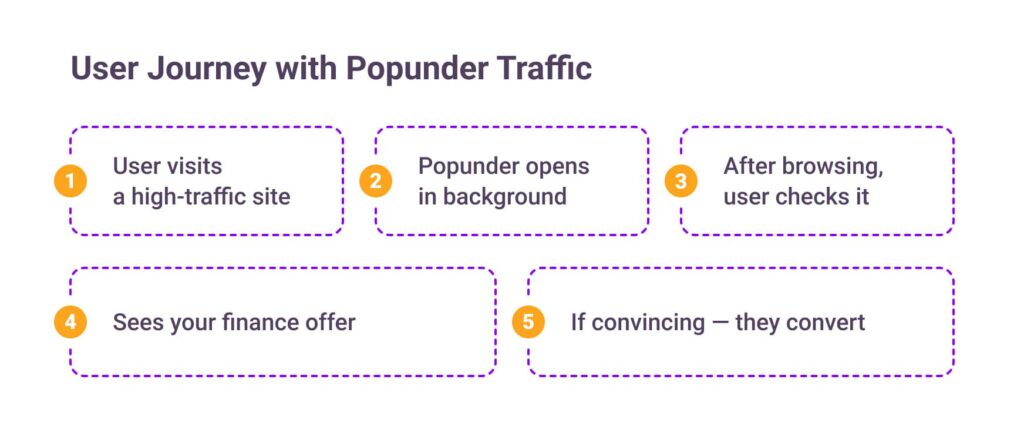

One of the best things about pop ads is that they don’t rely on traditional creatives like banners or headlines — the user is dropped directly onto your landing page. That means the real “creative” work lies in the offer page, pre-landing, and funnel structure.

But don’t get me wrong — your approach still needs to be strategic and targeted, especially in the competitive finance vertical.

Here’s how to make your finance offers convert on popunder traffic in the US.

Ideal Funnel Structure for Finance Campaigns

- Use pre-landing when the main offer page looks too aggressive or untrustworthy.

- No pre-landing needed if your main page already includes trust signals, clean layout, and legal disclaimers.

- Always test both options — especially for crypto, loan, and trading offers.

Top 5 Creative Approaches for Finance Offers on Pop Traffic

One of the best things about pop ads is you don’t need banners or creatives in the traditional sense — the user lands directly on your funnel. But that doesn’t mean you can ignore your messaging. On the contrary, the landing page is your creative, and the story it tells must resonate with finance users.

Here are 5 high-converting creative strategies for promoting finance offers via pop traffic in the US.

1. Urgency + Big Promise

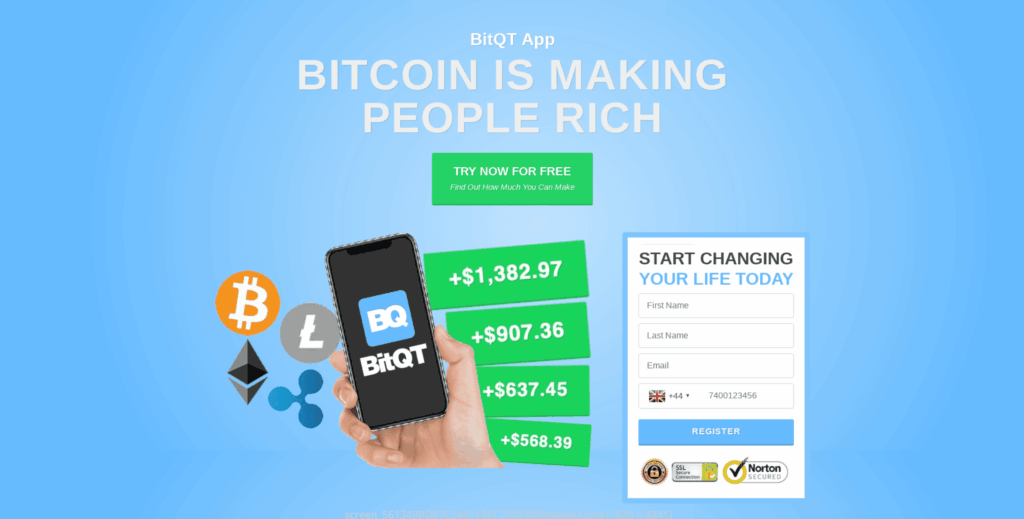

This uses bold, emotional headlines like “Bitcoin is making people rich” or “Start earning $1,000/day today.” Creates a sense of urgency and gets users to act fast. Works well in popunder ads where you have the user’s full attention.

- Good for crypto and trading finance offers

- Works with FPA or SOI flows and fast pre-landers

- Works across high-volume popunder ad networks targeting Tier 1 geos

2. Quiz-Based Engagement

Interactive funnels like personality quizzes or financial readiness tests grab attention and pre-qualify leads. For example, “Would you be a good investor?” followed by 5–7 engaging questions can warm up cold popunder traffic before revealing the main finance offer.

- Good for financial education tools, trading apps, or budgeting services

- Increases engagement on pop ads and leads to better CR on lead gen forms

- Works best with mobile finance traffic in the US

3. Trust & Simplicity

Sometimes, less is more. This approach mimics the style of real financial institutions — think clean design, official branding and visible trust elements like regulatory badges or security seals. Good for finance vertical offers that require user trust, like broker platforms or licensed fintech tools.

- Works with cautious users on desktop pop traffic

- Good for building credibility in a saturated finance advertising space

- Matches user expectations from regulated sectors like banking or investment

4. Personal Finance Tools

Loan simulators, credit score checkers and budget calculators are classic tools that users love to interact with. These tools serve as a powerful entry point into a finance ad funnel. Pair them with popunder traffic, and you’ll capture users who are already in a problem-solving mindset.

- Good for short-form finance offers like payday loans or debt relief

- Pre-qualifies leads before they hit the main offer page

- Enhances UX and time-on-site for better ROI with pop ads

5. Lifestyle Transformation

This targets emotion and aspiration: “Quit your job. Earn money online. Change your life.” Bright visuals, success stories and clean mobile-optimized design makes it highly effective for softer finance advertising offers like hustle apps or beginner crypto platforms.

- Strong on mobile pop traffic where lifestyle funnels convert

- Converts on Tier 2–3 audiences, especially with push-to-pop hybrid testing

- Use on popunder ad networks with broad reach and segmentation

If you’re running popunder ads for finance offers, think of your landing page as your most important asset. It replaces the creative — and must be built to capture, convince and convert in seconds.

Optimization Strategies for Finance Pop Campaigns

Running finance ads on popunder traffic in the US can be very profitable — if you’re tracking and optimizing every step. Since pop traffic is high volume and low cost, the key is to quickly filter out bad sources and scale what works.

Here’s how to structure your optimization process when working with finance vertical offers on popunder ad networks like ROIads:

1. Use Conversion Tracking from Day One

Set up server-to-server (S2S) postback tracking with platforms like Voluum, Keitaro, or RedTrack. This allows you to:

- See which traffic sources (publishers, zones, placements) actually convert

- Analyze EPC, CR, ROI in real-time

- Automate bid adjustments based on conversion data

Without tracking, you’ll waste most of your popunder traffic budget on blind tests.

2. Launch with Broad, But Controlled Targeting

Start with wide geo + device targeting (e.g., United States, desktop only), but set strict rules:

- Cap impressions per user (e.g., 1–2 per 24h)

- Limit daily budget per campaign ($30–$50 per test funnel)

- Split campaigns by OS or browser if needed

This will help you collect clean data while preventing overspend during the testing phase.

3. Segment & Analyze by Source

With ROIads’ Micro bidding feature, you can:

- Increase bids for high-performing sources

- Cut or blacklist poor-quality placements

- Create separate whitelists for different finance offer types (e.g., one for loan apps, another for crypto)

This source-level bidding strategy is key to long-term scaling on pop ads.

4. Test Multiple Funnels

Your landing page is everything in popunder advertising — test aggressively:

- One-page landing vs. pre-lander + LP funnels

- Different hooks: urgency vs. trust vs. financial tool

- Variants with or without exit popups, badges, etc.

Track which versions work best for different parts of your finance traffic (e.g., mobile vs. desktop).

5. Monitor Conversion Delay

In the finance vertical, users don’t convert instantly — be patient and:

- Track delayed conversions over 12–48 hours

- Check time-to-convert in your tracker

- Don’t cut sources too early based on same-day stats

Especially with trading or loan offers, decision-making takes time — so trust your data, not just early CTR.

Well-optimized popunder campaigns can bring big, scalable results in the finance niche — but only if you work with the right tools, traffic, and strategy.

Case Study: Real Results with Finance Offers on Popunder Traffic

Running finance offers with popunder ads isn’t just theory — it’s a proven strategy that delivers real ROI when executed correctly.

Want proof? Check out live examples from ROIads:

Conclusion

The finance vertical is hot — and affiliates who move fast, test smart and optimize well are already making money. But here’s the truth: traditional channels like search and native are crowded, expensive and often too restrictive for aggressive scaling.

Popunder traffic is still a hidden gem — especially in the US market.

You get massive reach, full control over the funnel and low entry costs. Add that to ROIads’ high-quality premium traffic, AI bidding technology, Micro bidding and transparent campaign analytics — and you have the perfect setup for long-term profitability in the finance advertising game.

Whether you’re running loan apps, crypto tools, credit score offers or anything in between — it’s time to act.