Brief content: Some of the best ad networks for affiliate marketing in Indonesia in 2026 are ROIads, RichAds, FataAds, PropellerAds, ClickAdu, and more. These networks work well with push and pop traffic, have good targeting tools and perform well in popular verticals like gambling, dating and finance. Traffic Nomads and Adsterra are also good options if you’re looking for affordable, mobile-friendly traffic with good volume across Tier-3 geos like Indonesia.

Indonesia is one of the most promising markets for affiliate marketers in 2026. With over 270 million people, high mobile penetration and increasing interest in online services, it’s no surprise that advertisers are looking for the best ad networks for affiliate marketers in Indonesia.

But with dozens of affiliate ad networks in Indonesia offering push, pop, native and more other traffic, how do you choose the right one? Whether you’re running dating, finance, sweepstakes, gambling or software offers, choosing the right traffic source is crucial to scale your campaigns efficiently and profitably.

In this guide, we’ve compiled a list of the 14 best ad networks for Indonesia that work for both advertisers and publishers. These networks have strong targeting capabilities, affordable rates and access to premium traffic segments in Indonesia — including mobile-optimized formats like push and pop.

Here’s what you’ll find inside:

- A breakdown of the top 14 affiliate advertising networks for Indonesian traffic

- Key ad networks features

- A comparison table of the top advertising networks for Indonesia

- Expert tips on how to advertise in Indonesia online

🔥 Hot Picks: Top 3 Ad Networks for Indonesia in 2026

1. ROIads — Push and pop traffic with AI bidding and Micro bidding. Steady Indonesia volumes. Works well for gambling and finance. Manager support from $500.

2. RichAds — 5B+ daily impressions. Strong push and in-page push in Indonesia. Includes CPA Goal and source-level optimisation.

3. PropellerAds — Large Indonesia inventory. Push, in-page, interstitial, and popunder formats. Reliable for gambling, sweepstakes, and apps.

Comparison Table: Top Advertising Networks for Indonesia

If you’re looking for the best ad networks for affiliate marketers in Indonesia, this table gives you a clear comparison of 14 top platforms. We’ve included formats, minimum deposit, top verticals and how well each network performs with Indonesian traffic.

| Ad Network | Formats | Min Deposit | Top Verticals | Traffic Features |

|---|---|---|---|---|

| ROIads | Push, Pop, Direct Click, In-page Push | $250 | Finance, Gambling, Dating | Premium fresh traffic, high volume, AI & Micro Bidding |

| RichAds | Push, In-page push, Popunder, Native, Direct Click, Telegram Ads | $100 | Finance, Dating, Sweepstakes | 5B+ daily, segmented sources, advanced automation |

| PropellerAds | Telegram Mini Apps, Push, In-Page Push, Popunder, Interstitial, Survey Exit | $100 | Utilities, Gambling, Finance | 12B+ daily, automation (CPA Goal), strong SEA reach |

| FatAds | Push, Pop | $100 | Gambling, Finance, Dating | Aggressive Tier-2/3 focus, fast scaling, raw volume |

| Adsterra | Popunder, In-Page Push, Interstitial, Banner, Native, Social Bar | $100 | Gambling, Apps, Finance | 30B+/month, fast approvals, custom zones |

| Kadam | Banner, Native, Push, Popunder, In-Page Push, In-App Push | $50 | Dating, Finance, App Installs | 300B+/month, 195+ countries, flexible CPC/CPM/CPA |

| AdMaven | Pop, Push, Interstitial, In-Page Push, Content Locker | $100 | Utilities, Sweepstakes, Finance | Strong pop inventory, content locker funnel support |

| ClickAdu | Popunder, Banner, In-Page Push, Instant Text Message, Video Pre-Roll, SKIM | $100 | Finance, Dating, Software | 6B+ daily, strong pop performance |

| Traffic Nomads | Push, Pop, Native, In-Page Push, Calendar, Banner | $100 | Betting, Casino, App Installs | Tier-2/3 focused, clean mobile delivery |

| TacoLoco | Direct Clicks, In-Page Push, Push, Popunder, Banners | $50 | Dating, Sweepstakes, Lead Gen | Click-focused, fast tests, good for Tier-3 |

| Zeropark | Pop, Domain Redirect | $200 | E-commerce, Sweepstakes | Intent-based, RTB, keyword/source targeting |

| HilltopAds | OnClick (Pop), In-Page, Banner, Video | $50 | Finance, Crypto, Utilities | CPM-based, anti-bot filters, instant launch |

| Galaksion | Interstitial, Push, On-Page Notification, Native, Direct Link | $100 | Software, App Installs | Direct in-house traffic, pre-moderated |

| MGID | Native | $100 | Finance, E-commerce | 185B+/month, premium publishers, content-driven |

If you’re serious about this vertical make sure to check our step-by-step guide to gambling traffic in Indonesia.

14 Best Ad Networks for Affiliate Marketers in Indonesia

If you’re planning to run profitable affiliate campaigns in Indonesia, choosing the right traffic source is everything. Whether you’re promoting finance offers, gambling, dating or mobile apps — the performance of your campaign depends heavily on where you buy traffic.

Below is our expert list of the 14 best ad networks for affiliate marketers in Indonesia. All platforms have been tested in real campaigns and selected based on traffic quality, vertical performance, pricing and relevance for Indonesian geo.

Let’s break down each of these affiliate advertising networks — one by one.

8. Clickadu

9. Traffic Nomads

10. TacoLoco

11. Zeropark

12. HilltopAds

13. Galaksion

14. MGID

1. ROIads

ROIads is one of the top performing affiliate ad networks in Indonesia, offering premium push and pop traffic optimized for Tier‑2/3 geos like Indonesia. The platform stands out with smart bidding tools including AI bidding technology and Micro bidding which allow advertisers to fine-tune performance down to the source level.

Key Features:

- Ad Formats: Push, Pop, Direct Click, In-page Push

- Minimum Deposit: $250

- Geos: 150+ countries, with strong Indonesian coverage

- Top Verticals: Gambling, Dating, Finance, Sweepstakes, Antivirus

- Optimization Tools: Micro bidding, AI bidding technology, CPA goal, frequency settings, blacklist/whitelist, Optimization rules

- Support: Personal account manager from $500 deposit, fast moderation, Telegram channel

ROIads ad network is perfect for affiliates looking to monetize traffic in Indonesia with high-converting formats and real time bidding control. It also integrates with major trackers like Voluum, Keitaro, RedTrack, BeMob, and more — so you can launch and optimize quickly.

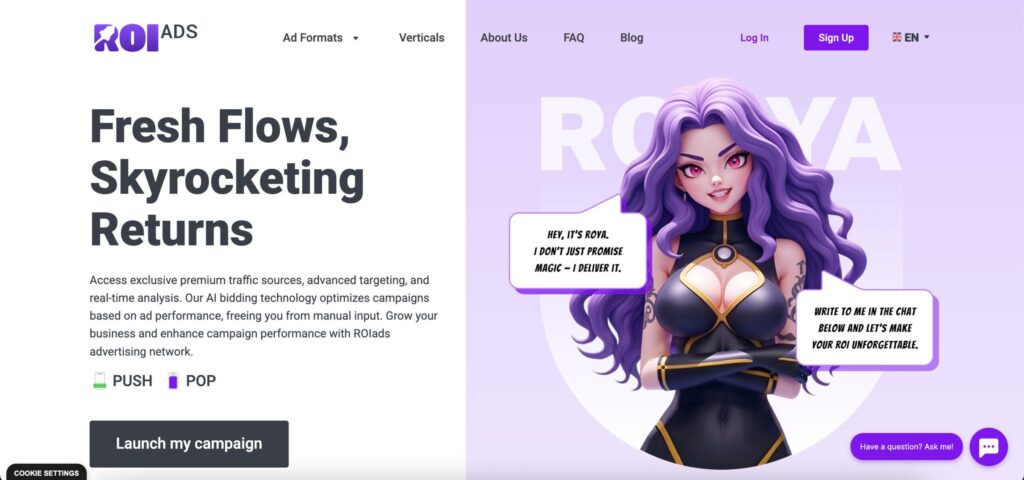

After registration, the dashboard provides Insights for 150+ geos, including Indonesia, showing available traffic volumes, average and top CPC/CPM rates, win rate statistics, and segmentation by format and traffic type (desktop or mobile).

If you’re looking for a reliable partner among the best ad networks for advertisers in Southeast Asia — ROIads should be at the top of your list.

2. RichAds

RichAds is a performance ad network for Indonesia campaigns, especially in Tier 2–3 regions. The platform delivers 5+ billion impressions per day across 220+ countries, supports 6 formats and is used for dating, sweepstakes, casino and finance offers — all work well in Indonesia. Micro bidding and CPA goal are used by affiliates to optimize traffic sources and scale only profitable zones. Moderation is fast and creatives pass easily even in sensitive verticals which is important for local test speed.

Key Features:

- Ad formats: Push, In-Page Push, Popunder, Native, Direct Click, Telegram Ads

- Traffic volume: 5B+ daily impressions

- Coverage: 220+ countries (wide reach in Indonesia, including mobile traffic)

- Minimum deposit: $100

- Top verticals: Dating, Sweepstakes, Casino, Finance

- Optimization tools: Micro Bidding, CPA Goal, Performance Mode, Automated Rules

- Integrations: All major trackers supported (Voluum, Keitaro, RedTrack, etc.)

- Support & moderation: 24/7 live chat, manager from $500 deposit, fast approval

Pros

- High traffic volumes suitable for scale in Tier 2/3 markets

- Precise bid control via Micro Bidding and source-level stats

- Wide targeting flexibility (geo, device, OS, browser language, etc.)

Cons

- Full support and deeper assistance only from $500 deposit

- Requires structured optimization — manual setups can drain budget if unmanaged

3. PropellerAds

PropellerAds is one of the best affiliate network for Indonesian traffic due to its huge reach (12+ billion daily impressions) and built-in automation. It’s used for utilities, finance, gambling and betting campaigns — especially for fast-scaling setups where affiliates rely on automated optimization rather than manual bid control. Creative approval is quick, delivery is stable across Southeast Asia and ad formats cover both aggressive and soft funnel strategies.

Key Features:

- Ad formats: Telegram Mini Apps, Push, In-Page Push, Popunder, Interstitial, Survey Exit

- Daily volume: 12B+ impressions (strong delivery in Indonesia, especially mobile)

- Minimum deposit: $100

- Top verticals: Utilities, Finance, Gambling, Software, Betting

- Optimization tools: CPA Goal 2.0, Smart Rotator, rule automation

- Integrations: Voluum, RedTrack, Binom, Keitaro, BeMob, and others

Pros

- Huge traffic volume for scaling betting and finance in Southeast Asia

- Strong automation (CPA Goal 2.0, Smart Rotator) reduces manual workload

- Fast campaign launches and moderation

Cons

- Requires solid funnel quality — AI tools need conversion data to optimize

- Less granular control over sources compared to platforms with Micro Bidding

4. Kadam

Kadam is a budget-friendly ad network for Indonesian traffic, especially for affiliates testing campaigns or working with smaller budgets. The platform has been around since 2012, delivers 300+ billion monthly impressions across 195 countries and supports 6 ad formats which allows to test different funnel types in Tier-3 markets like Indonesia. Minimum deposit is $50 so it’s accessible for both beginners and for quick hypothesis validation.

Key Features:

- Ad Formats: Banner, Native, Push, Popunder, In‑Page Push, In‑App Push

- Traffic volume: 300B+ impressions per month

- Minimum deposit: $50 (refill from $50)

- Top verticals: Dating, Finance, App Installs

- Targeting & controls: Blacklists/whitelists, frequency capping, scheduling

- Support: Ticket system, fast moderation

Pros

- Very low entry point ($50) — good for testing and small budgets

- Large Tier-3 traffic volume with six formats to test multiple angles

- Flexible pricing (CPC, CPM, CPA) for budget planning

Cons

- Standard support — manager is not guaranteed without proven spend

- No advanced automation (importantly less optimization depth vs bigger networks)

5. FataAds

FataAds is a young but fast-growing affiliate ad network focused on push and pop traffic, built for affiliates who want quick testing and aggressive scaling in Tier-2 and Tier-3 markets like Indonesia. Despite being new, the platform already handles millions of daily impressions and is gaining popularity among media buyers running betting, finance and dating offers. Minimum deposit is $100 and traffic is segmented clearly at the source level which helps to optimize faster without complex tools.

Key Features:

- Formats: Push, Popunder

- Traffic volume: Several million impressions per day across Tier-2/3

- Minimum deposit: $100

- Top verticals: Gambling, Finance, Dating, Sweepstakes, Software

- Targeting: Source-level control, blacklist/whitelist setup, click caps

- Support: Fast Telegram assistance

Pros

- High-volume Tier-2/3 traffic, including strong results in Indonesia

- Simple self-serve setup, quick launch, no unnecessary complexity

- Source segmentation helps optimize manually without heavy automation

Cons

- Only two formats (push and pop) — no testing flexibility outside core funnels

- No advanced optimization tools — works best for experienced buyers who optimize manually

6. AdMaven

AdMaven is an old ad network with strong presence in Tier-2 and Tier-3 regions, including Indonesia. They deliver over 1 billion impressions daily across 180+ countries, most of which is pop and push, so good for aggressive verticals like utilities, finance and sweepstakes. A bonus for affiliates is the Content Locker feature — good for mobile lead gen and subscription funnels. Min deposit is $100 and moderation is fast so you can test quick.

Key Features:

- Ad Formats: Pop, Push, Interstitial, In‑Page Push, Content Locker

- Traffic volume: 1B+ impressions per day across 180+ countries

- Minimum deposit: $100

- Top verticals: Utilities, Sweepstakes, Finance, Software

- Targeting: Geo, device, OS, browser, language

- Support: 24/7 chat and dedicated account managers

Pros

- High inventory in Tier-3 markets like Indonesia, good for fast testing

- Content Locker format available (rare among networks at this scale)

- Simple launch process and fast approval

Cons

- Limited automation tools — manual optimization required

- Traffic quality varies across sources, whitelisting recommended early on

7. Adsterra

Adsterra is used by affiliates targeting Indonesia because of its stable delivery in Tier-2 and Tier-3 regions. They push over 30 billion impressions monthly across 240+ countries, popunder is the strongest format for aggressive verticals. Fast moderation and flexible campaign settings make it good for testing and scaling finance, gambling and sweepstakes offers. Min deposit is $100 but a personal manager activates from $500 which helps when scaling profitable campaigns.

Key Features:

- Formats: Popunder, In-Page Push, Interstitial, Banner, Native, Social Bar

- Traffic volume: 30B+ impressions per month across 240+ countries

- Minimum deposit: $100

- Top verticals: Gambling, Apps, Finance, Sweepstakes

- Targeting: Geo, OS, device, browser, connection, zone-level segmentation

- Support: Live chat, personal manager from $500

- Tools: Blacklist/whitelist, frequency caps, anti-fraud filtration

Pros

- Strong popunder traffic in Indonesia and surrounding Asian regions

- Wide format range for different funnel types

- Fast approvals and convenient launch process

Cons

- Best optimization tools unlocked only with higher budgets

- Traffic quality varies — manual filtering needed at scale

8. ClickAdu

ClickAdu is a pop driven ad network with high volume in Tier-3 markets like Indonesia. They deliver over 2 billion impressions daily across 240+ countries, popunder is the strongest format. Min deposit is $100 so it’s good for testing. Supports additional formats like banners, in-page push and video pre-roll so you can test softer funnels too. Campaign setup is fast and targeting is easy — good for those who want to run quick test cycles without complex automation.

Key Features:

- Formats: Popunder, In-Page Push, Banner, Instant Text Message, Video Pre-Roll, SKIM

- Traffic volume: 2B+ daily impressions in 240+ countries

- Minimum deposit: $100

- Top verticals: Sweepstakes, Utilities, Dating, Gambling

- Targeting: Geo, OS, device, browser, connection

- Support: Live chat, manager for active advertisers

- Other tools: Smart rotation, blacklist/whitelist, frequency caps

Pros

- Strong popunder traffic in Indonesia

- Multiple formats for testing different funnel types

- Smart rotation helps improve CR without manual bidding

Cons

- Automation limited vs larger platforms

- Quality can fluctuate — needs monitoring during scaling

9. Traffic Nomads

Traffic Nomads is a growing affiliate ad network with a strong focus on mobile traffic and clear source segmentation which makes it good for campaigns in Indonesia. They deliver around 1.5+ billion impressions per day across 190+ countries, Tier-2/3 markets are a priority including solid volumes in Southeast Asia. Min deposit is $100 and formats are push, pop and native — good for testing different funnel types. Reporting is transparent, setup is simple and support reacts quick via Telegram which helps during rapid testing.

Key Features:

- Ad Formats: Push, Pop, Native, In‑Page Push, Calendar Ads, Banner

- Daily impressions: ~1.5B across 190+ countries

- Minimum deposit: $100

- Top verticals: Betting, Casino, App Installs, Finance

- Tools: Auto-optimization, zone targeting, frequency caps

- Support: Fast via Telegram, manager available for scaling

Pros

- Strong mobile delivery in Indonesia

- Clear segmentation and easy campaign setup

- Responsive support, good for rapid testing

Cons

- Volume strong but may require extra filtering for aggressive funnels

- Lower automation depth vs top-tier platforms

10. TacoLoco

TacoLoco is a lesser known but performance focused ad network with around 700M+ daily impressions across 120+ countries, so good for Indonesia and other Tier-3 markets. Main strength is direct click and push formats which allows for quick setup and fast traffic delivery — often used for sweeps, dating and lead-gen offers. Min deposit is $50 and pricing is affordable so good for testing new funnels before scaling.

Key Features:

- Ad formats: Direct Clicks, Push, In-Page Push, Popunder, Banners

- Daily impressions: ~700M across 120+ countries

- Minimum deposit: $50

- Top verticals: Dating, Sweepstakes, Lead Generation

- Tools: Device targeting, click caps, basic optimization

- Support: Telegram-based, rapid moderation

Pros

- Very fast launch, minimal setup needed

- Good volumes in Tier-3, including Indonesia

- Competitive entry cost ($50)

Cons

- Limited automation and control tools

- Traffic quality may vary, requires filtering on scale

11. Zeropark

Zeropark is a performance-focused ad network with intent based traffic from domain redirects and pops, so affiliates can capture users actively looking for similar content. They deliver over 1.5B ad requests daily across 180+ countries, so while it’s not Indonesia specific, Tier-3 traffic (including Southeast Asia) can work if you use precise keyword or source targeting. Min deposit is $200 so more suitable for experienced media buyers testing high-ROI funnels like e-commerce, sweeps and aggressive lead-gen.

Key Features:

- Ad formats: Pop, Domain Redirect (keyword, source, RON)

- Approx. daily volume: 1.5B+ ad requests across 180+ countries

- Minimum deposit: $200

- Top verticals: E-commerce, Sweepstakes, Lead Generation

- Tools: Keyword & source targeting, IP filtering, conversion tracking, rule-based optimisation

- Support: Email, live chat, manager by request

Pros

- Strong intent-based traffic (domain redirects)

- Advanced targeting granularity (keywords, IPs, sources)

- Works well for high-conversion funnels when optimised

Cons

- High minimum deposit ($200)

- Requires precise targeting and budget testing to avoid waste

12. HilltopAds

HilltopAds is a CPM-based ad network focused on pop and in-page formats, delivering stable volume in Tier-2 and Tier-3 markets — including solid coverage in Indonesia. The platform serves over 1B monthly impressions in Southeast Asia alone, which makes it suitable for finance, crypto and utilities campaigns where scale and cheap traffic matter. With a $50 minimum deposit and instant approval, it’s often used for quick tests or monetizing low-cost traffic, especially on desktop.

Key Features:

- Ad formats: Popunder, In-Page, Banner, Video

- Minimum deposit: $50

- Volume: 1B+ monthly impressions in Southeast Asia

- Top verticals: Finance, Crypto, Utilities

- Tools: CPM bidding, frequency filters, zone-level stats

- Support: Live chat, email, manager available for scaling

Pros

- Very low entry threshold

- Stable Tier-2/3 delivery (Indonesia included)

- Zone reports help cut weak traffic fast

Cons

- Basic optimization only

- Quality varies, requires strict filtering early on

13. Galaksion

Galaksion is a direct ad network with fully in-house traffic, which gives affiliates more control over placements and cleaner delivery compared to open-source platforms. It serves over 1.2B monthly impressions across Southeast Asia, including strong inventory in Indonesia, making it suitable for campaigns where compliance is critical. The network works well with app installs, software and utilities, thanks to pre-moderated traffic and transparent zone-level stats.

Key Features:

- Ad formats: Interstitial, Push Notification, On-Page Notification, Native, Direct Link

- Minimum deposit: $100

- Monthly volume: 1.2B+ impressions in Southeast Asia

- Top verticals: Utilities, Software, App Installs

- Traffic: Direct in-house inventory (full transparency)

- Tools: Device targeting, creative rotation, real-time stats

Pros

- Direct traffic without intermediaries

- Strong compliance suitability (useful for apps and utilities)

- Transparent inventory and zone-level clarity

Cons

- Higher minimum deposit than some competitors

- Limited automation — works best for hands-on optimization

14. MGID

MGID is a native advertising network with strong presence across Southeast Asia, including Indonesia. The platform delivers over 185 billion impressions monthly in 200+ countries, offering affiliates access to premium editorial placements — ideal for finance, ecommerce and lead-gen funnels when paired with pre-landings or advertorials. It’s more compliance-focused than push/pop networks, so works best for long-form strategies and mid-funnel traffic testing.

Key Features:

- Minimum deposit: $100

- Traffic volume: 185B+ monthly impressions globally (strong Indonesia reach)

- Top verticals: Finance, E-commerce, Lead Gen, Nutra

- Traffic type: Native placements on premium publishers

- Tools: Audience interest targeting, pre-lander integration, performance insights

- Support: Dedicated account manager, strategic setup

Pros

- High-trust traffic from top publishers

- Works well with editorial-style pre-landers

- Stable delivery for long-term funnels

Cons

- Higher entry costs compared to push/pop traffic

- Not suited for aggressive direct-to-offer funnels

FAQ About Best Ad Networks and Affiliate Traffic in Indonesia

❓Why Indonesia is s a goldmine for affiliate campaigns in 2026?

Indonesia has become a top geo for affiliate marketing — and in 2026 it’s only getting bigger. With a digital-first population, high mobile penetration and openness to online offers, the country is a perfect environment for performance campaigns.

Here’s why more and more advertisers are looking for ad networks for affiliates that support Indonesia:

- Mobile-first behavior: 70%+ of the population accesses the internet via mobile devices. This makes push and pop traffic very effective.

- Low competition, high ROI: Compared to Tier-1 geos, Indonesia has cheaper traffic and still converts well across multiple verticals.

- Massive audience: 270 million+ population = huge traffic volumes at affordable CPM/CPC rates.

- Diverse verticals: Top performing verticals in Indonesia is iGaming, dating, finance and loans, app installs and utilities, sweepstakes

And yes — gambling is one of the most profitable verticals in this geo. That’s why we’ve created a dedicated guide with everything you need to know about running gambling traffic in Indonesia: formats, creatives, targeting tips and best sour

❓What are the key criteria to choose an affiliate ad network for Indonesia?

Before diving into a list of the best ad networks for Indonesia, you need to know what makes a network good for this geo. Not all affiliate advertising networks are created equal — especially when it comes to specific countries like Indonesia where mobile usage, pricing sensitivity and vertical preferences matter.

Here’s what to look for when choosing the best ad networks for affiliate marketers in Indonesia:

1. Traffic Type & Formats Supported

You need a network that offers formats that work in Southeast Asia:

- Push notifications — top format for mobile users and aggressive lead-gen

- Pop (popunder) — good for software installs, sweepstakes, gambling

- In-page push — good for visibility and CTR on both mobile and desktop

- Native ads — useful for long funnels or advertorial pre-landings

2. Targeting Options

To run affiliate campaigns you need to target users precisely. Look for ad networks that offer:

- Device targeting (Android focused is a must)

- Browser targeting (Chrome dominates)

- OS targeting (Android vs iOS split)

- Carrier/ISP targeting (especially for sweepstakes and mobile content)

- Frequency capping and click limits to prevent overexposure

3. Geo and Traffic Segmentation

Even if a network claims to support Indonesia, the quality of traffic can vary greatly. Look for:

- Geo-specific targeting presets or smart filters for faster optimization

- Large daily volume in Indonesia

- Premium traffic segments (Fresh, New, Premium — avoid remnant-only traffic)

4. Minimum Deposit & Payment Methods

Check your budget — some ad networks for Indonesia publishers and advertisers require higher initial deposits.

Also make sure payment options include crypto, cards, Capitalist, or wire — which are most popular among affiliates in the region.

5. Support & Moderation Speed

Indonesian traffic often requires fast creative rotation and flexible testing, so:

- Choose networks with quick moderation (under 1 hour)

- Look for personal account managers or Telegram support

❓ Which ad networks have high CPM in Indonesia?

High CPM means quality traffic — users are engaged and placements are performing well. Networks like RichAds, ROIads, FataAds have higher CPM in Indonesia because their inventory includes premium sources with high conversion potential. For affiliates, this means better ROI even if the initial bids are higher.

❓ What traffic types work best in Indonesia (push, native, pop)?

Push and pop formats perform best due to mobile-first user behavior. Native works for finance and ecommerce with softer funnels.

❓ Is Indonesian traffic good for affiliate marketing?

Yes. It’s cheap, scalable and converts well across high-ROI verticals like gambling, dating.

❓ What are the most profitable verticals in Indonesia?

Gambling, dating, finance, sweepstakes, mobile utilities always perform well in this market.

Final Thoughts

Indonesia is still one of the most profitable geo for affiliate marketing in 2026. With high mobile engagement, competitive traffic cost and strong performance across key verticals, it’s a must-test region for media buyers.

This list of the best ad networks for affiliate marketers in Indonesia includes proven networks for push, pop, native and direct click formats — all with Indonesian traffic and tools to scale.

Choose a network that fits your goals, test strategically and scale what works.