To get gambling traffic in Chile 2026, focus on push and pop ad formats via programmatic ad networks like ROIads. These formats work because they don’t have gambling restrictions, give direct access to mobile users (who make up most of the converting audience), and allow fast testing and optimization. Creatives should be simple, value-driven (e.g. bonuses, spins, sports-related triggers), and funnels should be quick with minimal steps. Chile is profitable right now because of fast user engagement and moderate competition so early optimization is more important than big budgets.

Chile is a stable geo for gambling campaigns. Internet coverage is high, mobile penetration is strong and users are used to online payments. If you’re looking for how to get gambling traffic in Chile there’s already demand for casino and betting offers.

The gambling market is active in 2026. Regulation is not fully defined yet so affiliates have space to test. Most traffic comes from mobile. Conversion rates depend on funnel speed and how fast the user reaches the deposit step.

Why affiliates consider this geo:

- moderate competition across LATAM,

- steady traffic volumes,

- predictable payouts,

- users respond well to simple creatives.

The market is not yet oversaturated so it’s good to get in and scale before bid pressure increases.

Economic Profile of Gambling Users in Chile

Online gambling in Chile is active despite no full regulation. Most users interact with offshore websites.

According to SCCG Management the market operates outside national licensing but continues to grow because of open digital access. The online gambling and casino segment is estimated to generate over $150M annually, with continued growth driven by mobile usage. Forecasts show the online sector could grow at ~9.3% CAGR between 2024–2027 due to increased digital payment adoption.

Typical spending patterns for online gambling users in Chile are:

| Economic Parameter (Online Only) | Estimated Value 2026 |

| Avg first deposit (CPA) | $12–18 (affiliate payout)* |

| Avg player deposit | $25–40 |

| Typical spend motivation | entertainment, betting events |

| Most used payment methods | debit/credit cards, e-wallets |

*CPA range based on common LATAM payout levels; direct source data unavailable – we’ll clearly mark that as estimated.

Users convert better when payments get to them fast and they have local payment options. The state of the economy suggests people are more likely to spend if an offer is direct and joining up is a breeze.

Demographic Profile

By 2026, Chile has a pretty impressive 18.6 million active internet users – that’s a whopping 94.1% of the population. With 30.7 million mobile connections on the go, people are often using multiple devices or Sims, which is great news for getting in front of more eyeballs with ad after all. The average age is 36.9, and gamblers in Chile tend to be concentrated in the 25-44 age range — that’s roughly 60% of all active users. As mobiles keep driving the growth in online casino and betting, we’re looking at 15-18% annual growth here.

The key demographic indicators look like this:

| Metric | Estimate (2026) |

| Mobile usage share | ~78% |

| Desktop usage | ~22% |

| Core age segment | 25–44 |

| Gender skew (betting) | mostly male |

| Gender skew (casino) | more balanced |

Users tend to convert early on in the funnel if an offer is up front and the registration process is pretty quick. The further down the funnel you go, the more likely they are to drop off if the page looks unfamiliar or you’re making things too hard for them.

Roya, Emotional Damage Officer & Supreme AI Arbitragist at ROIads

Advertising and Traffic Sources for Promoting Gambling in Chile

When running online gambling campaigns in Chile, you want to focus on channels where you don’t have to worry about strict licensing requirements. Any platforms with aggressive moderation policies can really limit your stability, so affiliates tend to go for sources that make it easy to set up and give you more control.

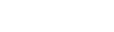

Some of the main traffic sources used for online casino and betting promotions are:

1. Social media advertising (restricted use)

- Facebook and Instagram enforce moderation for gambling content and often require proof of local licensing.

- Accounts risk suspension. Scaling is difficult.

- Can work via indirect funnels, but longer user paths reduce conversions.

2. Google Ads

- For the most part, gambling ads in Chile are forbidden unless the advertiser has a local license.

- Most people tend to rely on content domains and masking using alternative pages but the results are pretty hit and miss.

3. Content and influencer integrations

- Mostly used around big sporting events.

- Very high entry costs and it’s not scalable for performance-driven set ups.

- More suited for operators than affiliates.

4. SEO and long-term positioning

- Works well for review sites and comparison pages.

- Good for delivering steady traffic over time but not ideal for rapid testing or scaling.

5. Programmatic advertising and direct media buying

This is currently the most practical option for affiliates. Programmatic platforms let you buy traffic sources directly and test offers with full control over setup, bid strategy and source optimisation.

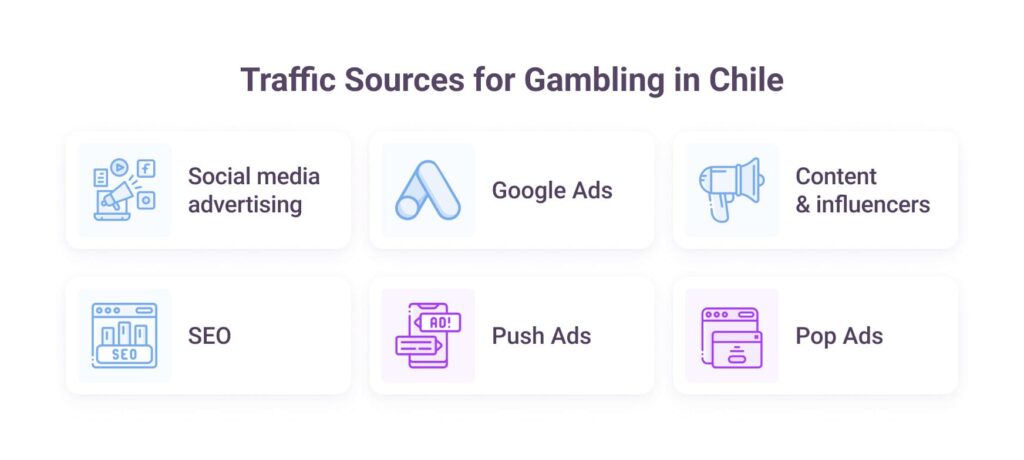

Here, the best results usually come from formats with no targeting restrictions — primarily push traffic & pop ads. These formats let affiliates access casino traffic in Chile and betting traffic in Chile efficiently, without having to rely on 3rd party approval systems.

Benefits of using programmatic ad networks for gambling campaigns:

- direct access to traffic sources,

- fast creative testing,

- ability to track and optimise conversions,

- flexible pricing models (CPC, CPM),

- possible to make granular source adjustments and scale without having to redesign the campaign.

How to Buy Gambling Traffic in Chile Through Ad Networks

When entering the Chile gambling market, affiliates tend to go for ad networks that allow direct campaign launches without category restrictions. Unlike Google and social platforms which require a license or apply very aggressive moderation, programmatic networks with push and pop formats don’t enforce local compliance barriers for casino or betting offers.

This makes them the safest and most scalable option for affiliates.

Why use ad networks instead of traditional platforms:

- no restrictions on gambling-related ads,

- no risk of account bans or policy disputes,

- faster launch and approval,

- clear control over spending and source selection.

Campaigns can be set live as soon as the creatives and links are ready. Most top performers start out with programmatic because of its predictability and absence of regulatory friction.

| Stage | What to do | Why it matters |

| Start | Launch with narrow targeting (only geo + device) | Fastest way to collect real data on source performance |

| Creatives | Use direct value messaging (bonus, free spins, sports match promo) | Chile users respond best to clear incentives |

| Frequency Cap | 1–3 impressions/day per user | Prevents fatigue and keeps CTR stable |

| Bid strategy | Use recommended CPM/CPC levels from platform | Ensures traffic volume without overpaying |

| Offers | Focus on quick-action or simple registration casino flows | Higher conversion on mobile |

| Optimization | Analyse CR per source → apply whitelist or apply bidding adjustments | Keeps spend only on converting sources |

| Scaling | Increase budget only after stable conversions over 48–72h | Avoids overspending on unstable segments |

Why this method works in Chile

- you can run gambling ads in Chile directly without having to cloak or use multi step funnels;

- offers get faster first-click conversions compared to social channels;

- lower risk of campaign disruption;

- easier testing and scaling process using standard optimisation logic.

Push traffic and pop ads are the most commonly used traffic sources due to immediate delivery and compatibility with the gambling vertical.

Why Launch Gambling Campaigns in Chile via ROIads

ROIads is built for performance-focused affiliates who work with casino and betting offers. The platform supports push traffic and pop ads, the two formats that work best in Chile due to their immediate delivery and absence of restrictions on gambling promotions.

In Chile, where most major ad platforms limit or block gambling content, ROIads lets you launch campaigns directly without relying on masking, compliance workarounds or gradual approvals. This reduces risk and speeds up testing.

Core Advantages of Using ROIads for Gambling Traffic in Chile

- Supports push traffic and pop ads, without gambling content restrictions.

- AI bidding technology reallocates budget toward converting sources.

- Micro bidding allows bid adjustments per individual source.

- CPA Goal helps optimize toward target payout levels.

- Traffic comes from real users, which improves conversion stability.

- Minimum deposit is $250, enough to start testing. For deposits from $500, a personal manager is assigned — provides recommended sources, adds whitelist and blacklist setups, and can help with free creatives for initial testing.

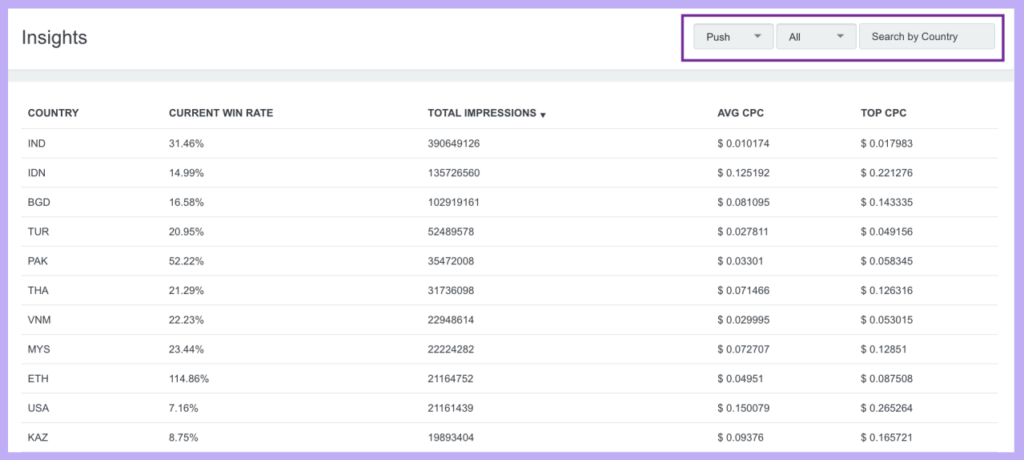

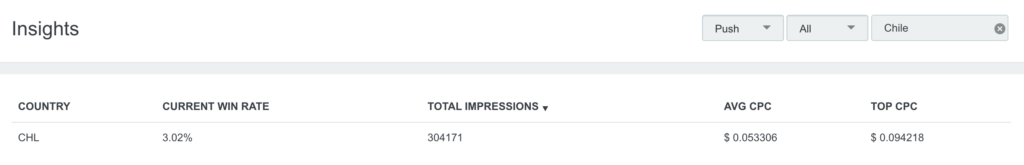

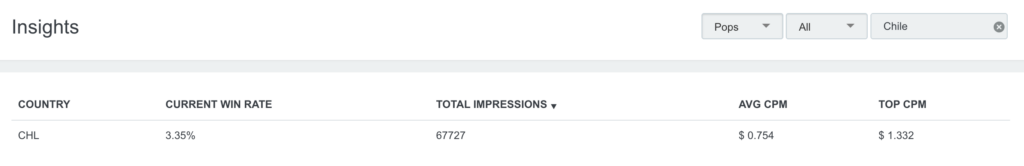

After registration, the dashboard provides Insights for 150+ geos, including Chile, showcasing available traffic volumes, average and top CPC/CPM rates, win rate statistics, and segmentation by format and traffic type (desktop or mobile).

After registration, the dashboard provides insights for 150+ geos, including available traffic volumes, average and top CPC/CPM rates, win rate statistics, and segmentation by format as well as traffic type (desktop or mobile).

Practical Tips for Launching in Chile

Chile setups should focus on quick engagement, low friction and easy testing. Mobile first approach is a must. Users respond to simple creatives and fast funnels.

Technical recommendations

- Mobile first. Most conversions happen on mobile.

- Frequency cap: 1–3 impressions per user per day.

- Landing page: must load in under 2 seconds.

- Tracking: integrate postback tracking to measure conversions per traffic source.

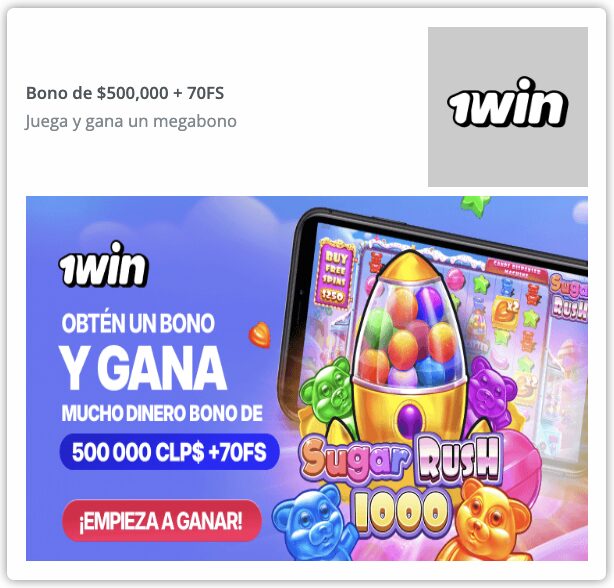

Creatives

- Focus on clear value messaging: bonus, free spins, match highlight, instant access.

- Short text performs better than stylised design.

- Do A/B test and add at least 3–5 creatives from launch.

- Static visuals often work more consistently than animated.

Offers and payouts

| Parameter | Recommendation |

| Offer type | Casino with fast registration, or betting tied to real events |

| Payouts | $12–18 per first deposit (CPA typical) |

| Funnel | One-click or short form preferred |

Launch strategy in ROIads

No traffic type selection — campaigns run on premium sources by default. This ensures a consistent level of traffic quality. At launch, you choose one of two optimisation approaches:

- AI bidding technology – recommended for the first phase when you need to collect data and quickly identify converting sources. The budget is automatically redirected based on performance.

- CPA Goal – if you already know expected payout levels and want the campaign to optimise directly to the target cost.

If unsure, start with AI bidding technology, evaluate conversion stability over 2–3 days, then consider switching to CPA Goal or apply Micro Bidding adjustments.

Optimization and scaling logic

| Phase | Action |

| Launch | Select AI Bidding or CPA Goal. Set bid based on platform recommendation. |

| Day 1–3 | Collect data on conversions per source. Monitor funnel behaviour. |

| Adjustment | Apply Micro bidding to reduce spend on weak sources and support strong ones. |

| Extended optimization | If CPA is stable, continue scaling or enable CPA Goal if not used initially. |

| Scaling | Increase budget gradually (no more than 15–20% per step). |

Additional insights for Chile

- Betting peaks around major football matches and international tournaments.

- Casino creatives with clear incentives outperform multi-layer bonus explanations.

- Users interact better with direct messaging than branded-style creatives.

- Scaling without stable conversion data often results in budget loss — delay until metrics are consistent.

More Geo Guides You’ll Find Useful

In addition, we’ve got even more country-specific articles to help you understand how gambling campaigns perform in different regions. These deep dives cover traffic sources, audience behavior, regulations and best practices to maximize ROI.

- 🇰🇭 Cambodia — Learn how to scale in this fast-growing online gambling market. [Read the guide →]

- 🇦🇷 Argentina — Which formats and geos work best in South America? [Read the guide →]

- 🇮🇱 Israel — Full overview of opportunities, ad formats, and compliance tips. [Read the guide →]

- 🇫🇮 Finland — Insights into one of Europe’s most gambling-friendly audiences. [Read the guide →]

- 🇪🇹 Ethiopia — Explore one of the fastest-growing African markets for casino and betting campaigns. [Read the guide →]

- 🇵🇭 Philippines — How to adapt creatives and traffic sources to a mobile-first audience. [Read the guide →]

- 🇮🇳 India — Practical strategies to succeed in a massive betting and casino market. [Read the guide →]

- 🇮🇩 Indonesia — Key tactics, traffic formats, and restrictions to know before launching. [Read the guide →]

And that’s just a few — we have more geo guides waiting for you. Head to the full section to see them all.

Also, you can check top gambling cases on ROIads traffic:

| Case Study | Format | Read More |

|---|---|---|

| Gambling in Ethiopia (AhaduBirr, ROI 185%) | Push Ads | Read guide → |

| Casino Traffic in Czech Republic (Mostbet) | Push Ads | Read guide → |

| Gambling Offer in Malaysia with 180% ROI | Pop Ads | Read guide → |

| Gambling in Azerbaijan — Strategy & Results | Push Ads | Read guide → |

FAQ: What People Also Ask About Gambling Traffic in Chile

❓What are the best traffic sources for gambling in Chile?

Push traffic and popunder ads perform best. These formats are not limited by gambling policies and give direct access to users. They work well for quick testing and scaling, especially for casino and betting offers. Other channels like Google Ads and social platforms either restrict or block gambling ads.

❓Which creatives convert best for the Chilean gambling market?

Simple, clear creatives with a direct incentive perform best. Mobile first layouts, short copy and strong value messaging (e.g. free spins, match bonus, quick payout) work better than branded or overdesigned visuals. For betting, sports driven creatives tied to real events show higher engagement.

❓How can affiliates lower rejection rates on Chile campaigns?

Use landing pages with minimal onboarding steps and make sure they load fast. Avoid claims that can be flagged as misleading. Run campaigns through ad networks that don’t require gambling licence validation — it reduces the risk of moderation or blocking. Optimise early to avoid overspending on weak sources.

❓Is Chile a profitable geo for gambling in 2026?

Yes, if you set up and optimise well. Users respond fast, competition is moderate and mobile traffic converts well. Profitability is not about high bids, but about funnel speed and traffic source selection. Early entry still has an advantage before the geo gets more competitive.

Conclusion

Chile is hot right now. Users convert fast, competition is moderate and traffic is easy to get through direct formats. Push and pop allow for fast testing and clear data. Here optimisation matters more than budget — optimise early, then scale.

Launching through ROIads ad network is easy: the formats work here and support is available when you start to scale. Worth entering now while traffic is still open and results come fast.