In affiliate marketing, few verticals show the same consistency and long-term profitability as dating. While trends come and go, human desire for connection never fades — and that keeps dating offers at the top of performance charts year after year.

Whether you’re promoting casual dating, relationship apps, or adult-oriented platforms, this vertical continues to deliver stable conversions, wide targeting potential, and high EPCs across multiple geos. In 2026, the demand for dating services remains strong — and with it, the demand for traffic that converts.

For affiliate marketers, the dating niche offers flexibility:

- Various offer types and flows to test

- Multiple monetization models

- A broad and diverse target audience

- Plenty of traffic sources to experiment with

Most importantly, it’s a vertical that works for both beginners and advanced media buyers. With the right traffic source, creative approach and a bit of testing, dating campaigns can scale fast and bring predictable results.

In this guide we’ll cover the current market landscape, the best traffic sources for dating offers and show you how to launch and scale profitable campaigns in 2026. You’ll also learn why push and pop ads are the most efficient channels for dating today — and how ROIads ad network helps affiliates maximize ROI with these formats.

Let’s get into it.

Dating Market Overview: Demographics & Economics

The global online dating market is evolving fast, shaped by mobile usage, social trends and shifting attitudes towards digital relationships. For affiliate marketers this means a stable and scalable opportunity — especially when paired with the right dating traffic sources.

Global Market Size and Growth

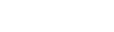

According to Grand View Research, the global online dating market size is projected to hit $15.9 billion by 2030, growing at a CAGR of 7.4%. This growth is fueled by:

- Widespread smartphone adoption

- Increasing internet penetration in emerging regions

- Growing social acceptance of dating apps

- Continuous innovation by platforms like Tinder, Bumble, and niche dating services

Regional Insights: Where the Dating Demand Comes From

Let’s break down some key regions for dating site traffic:

| Region | Notable Trends | Why It Converts |

| North America | High ARPU, mature audience, high EPC | Works well with both mainstream and adult dating |

| Western Europe | Broad targeting, strong purchasing power | Quality traffic for long-term dating flows |

| LATAM | Rapid mobile adoption, high engagement on casual offers | Great for SOI/DOI flows and sweepstakes hybrids (offers that combine a sweepstake hook with a dating) |

| Southeast Asia | Fast-growing user base, mobile-first behavior | Perfect for push and pop traffic formats |

| Eastern Europe | High activity in adult verticals, rising mainstream usage | Profitable for lower-CPC traffic campaigns |

Emerging markets like Brazil, India, Vietnam, and the Philippines are showing above-average growth in dating app usage, so media buyers can test fresh geos with low entry cost and scalable volume.

Dating Audience Demographics: Who You’re Targeting

Understanding the demographics of dating app users is crucial for affiliates looking to optimize their campaigns. Here’s a breakdown based on recent data:

Age Distribution:

- 18–29 years: 53% of U.S. adults in this age group have used a dating site or app.

- 30–49 years: 37% have used online dating platforms.

- 50–64 years: 20% in this bracket.

- 65+ years: 13% use dating apps or sites.

Gender Distribution:

- Male Users: On platforms like Tinder, men constitute approximately 75% of the user base.

- Female Users: Women make up about 24% of users.

Sexual Orientation:

- LGB adults are more likely to use online dating platforms, 51% vs 28% of straight adults.

Device Usage:

- Over 80% of dating site traffic is mobile, so mobile-optimized campaigns are key.

✅ Key takeaway for affiliates: The dating market in 2026 is global and flexible. Whether you’re running SOI offers in LATAM or subscription models in the US — there’s a traffic source and strategy that fits.

Now let’s look at the best traffic sources to promote dating CPA offers — and how to choose the right one for your goals.

Useful Data: Tinder as the Leading Dating Platform

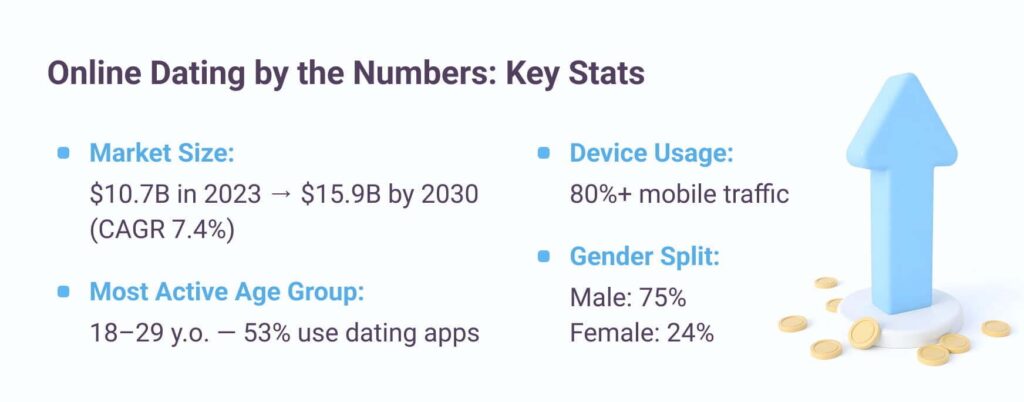

To get a better understanding of the demographics and economics of the dating industry, let’s look at Tinder — the world’s most popular dating app and a major driver of dating traffic in affiliate campaigns.

- Demographics Breakdown:

As you can see in the chart below, Tinder has the highest user penetration among 18–24 year-olds, over 50% of this age group are active on the app. Usage drops off sharply with older age groups, so Tinder is perfect for campaigns targeting younger audiences with casual or adult dating offers.

Tinder User Penetration vs. Other Dating Apps (% by age group)

- 52% of 18–24 year olds are on Tinder

- 34% of 25–34 year olds

- 10% of 35+ year olds use Tinder

- Other platforms like Bumble, Match.com and eHarmony skew towards older audiences

This makes Tinder a perfect benchmark for push and pop traffic campaigns targeting mobile users in the 18–34 age range — particularly in geos with high smartphone penetration.

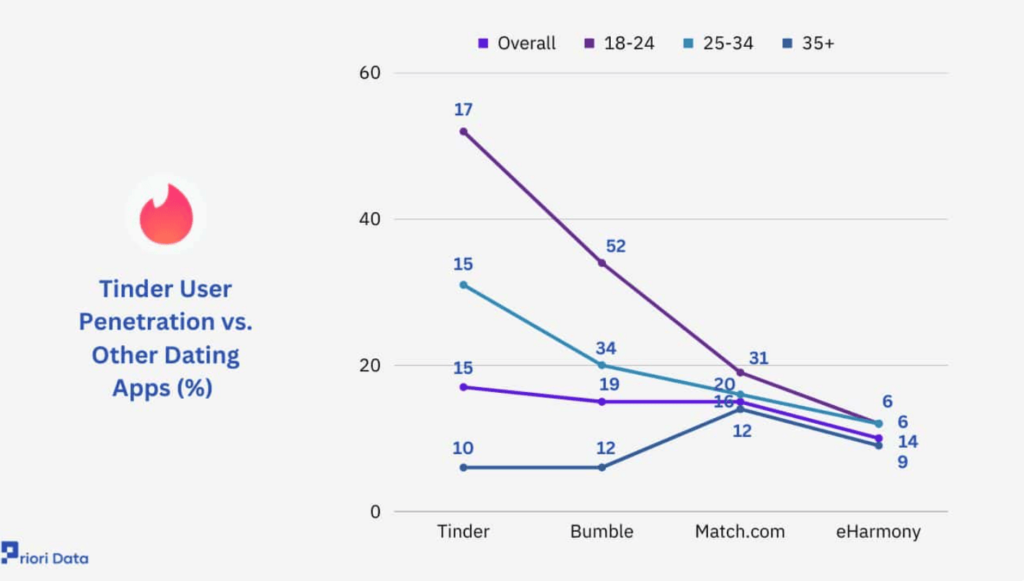

- Tinder Revenue Growth Reflects Market Potential:

Tinder’s revenue performance illustrates the massive financial potential of the dating vertical. In just seven years, the platform’s annual revenue grew from $47 million in 2015 to $1.79 billion in 2022 — a nearly 40x increase.

Tinder Annual Revenue ($mm)

This growth highlights two important points for affiliates:

- The demand for dating products is real and monetizable

- The industry is dominated by mobile, which aligns perfectly with push and pop traffic formats

What Are Dating Offers in Affiliate Marketing?

In affiliate marketing, the dating vertical isn’t just about “someone to meet someone.” It’s a complex and diverse niche that reflects the very human need for connection — whether romantic, casual or even explicit. For affiliates, this means the opportunity to work with a wide range of audiences, angles and funnels — and find traffic that matches the right user intent.

Let’s break down the core types of dating offers in 2026 — not by their tech setup but by who they’re for and why people click.

1. Mainstream Dating: For the Love-Oriented Swipers

This is the most common type of dating — the Tinder, Bumble or Match.com world. These platforms position themselves around long-term relationships or meaningful connections. The audience here is younger urban users — people in their 20s and early 30s who are used to app culture and aren’t shy about digital dating. Unlike casual traffic, these users are pickier, more ad aware and tend to engage better with clean creatives, emotional hooks and well-localized landings.

Mainstream offers work best in Tier 1 and Tier 2 geos and tend to convert better with slightly more polished or lifestyle-oriented approaches. These users aren’t looking for “fun tonight” — they’re exploring options. Push and native ads are perfect to catch them during idle app usage.

2. Casual Dating: The Swipe-and-Chat Crowd

Casual dating sits in the sweet spot between playful flirting and light adult content. It’s where the UX is fast, the sign up flow is simple and users want instant interaction. These offers target users from 18 to 40+, often skewing male and thrive in markets where fast gratification is a cultural norm — think Brazil, India, Indonesia.

Here emotional or romantic appeals don’t work. Instead what performs is direct language, curiosity triggers and mobile first funnels. Push and pop traffic excel here because the audience is open to impulse clicks. Volume beats precision — and the CR proves it.

3. Adult (18+) Dating: Where Fantasy Sells

This is the most aggressive part of the dating market. The user here isn’t looking for a soulmate — they’re looking for visual stimulation, chats with erotic tension or even paid access to explicit content. These offers target males 25-55 and are often paired with adult pre-landings or suggestive creatives.

Adult dating converts best in Eastern Europe, LATAM and parts of Asia — markets where adult content is popular but not always easily accessible. Push and pop are a natural fit here because of lack of moderation and ability to deliver volume at low cost. The key is to tease without overpromising and keep the funnel light.

4. Webcam & Live Chat Offers: Monetizing Attention

Unlike most dating offers, webcam/chat offers aren’t about fast lead gen — they’re about keeping the user engaged. These platforms earn from time spent, tokens or tips. The audience is often older, more willing to spend and interested in interaction more than outcome. This makes it perfect for long-term monetization models like RevShare.

To promote webcam offers affiliates often use clean pre-landings and soft adult creatives. Traffic from native or search is common but high-quality push can also deliver — especially when paired with a CTA like “Chat with someone near you.”

5. Niche or Localized Dating: Targeting Specific Needs

This type of offer serves specific user groups — from seniors and religious singles to LGBTQ+ communities or single parents. The appeal here is belonging. People using these services often feel underserved by big apps and respond well to authentic messaging.

These offers work best with laser focused creatives, geo specific landers and traffic that allows fine targeting. Push and native work well when combined with local language and cultural nuance. Volume may be lower — but CR and EPC are often higher due to user motivation.

Why Affiliates Choose Dating in 2026

- Fast payouts and high CR with simple flows

- Evergreen demand – people always seek relationships

- High mobile activity, perfect for push/pops

- Works in almost any region, even Tier 3

- Easy to test and scale, especially on self-serve platforms

Understanding Monetization Models in Dating Affiliate Marketing

Before you buy dating traffic or run a campaign, you need to know how you’ll get paid. Dating offers use several monetization models — each with its own flow, conversion logic and best-matching traffic sources. Some models focus on quick volume (like SOI), others are built for long-term ROI (like RevShare).

Choosing the right one depends on your traffic format, geo, audience type and risk appetite.

Here’s a breakdown of the most common models used in 2026:

💸 Common Monetization Models for Dating Offers

| Model | Description | Works Best With |

| SOI | User submits email or signs up in one step | Push, Pop |

| DOI | User confirms via email | Email, Native, Push |

| Trial | User enters payment for trial period | Native, Search |

| CC Submit | User submits credit card for subscription | Pops, Adult Push |

| RevShare | Long-term share of user spending | Push, Pop, Native |

SOI (Single Opt-In)

The most common flow in dating offers. The user only needs to enter an email, phone or name to convert — no confirmation required. This simplicity makes SOI offers great for cold traffic and high-volume channels like push and popunder. High CR, low-to-medium payouts, easy to scale. Perfect for Tier 2–3 geos with massive reach.

DOI (Double Opt-In)

Here, the user submits their info and then confirms it via email or SMS. This extra step filters out junk leads and increases user quality. DOI offers usually pay more than SOI and are common in EU geos where compliance is stricter. Pairing DOI with trusted-looking landings and clean creatives is key. Best promoted through email traffic, native ads or high-quality push.

Trial

In a trial flow the user provides credit card details to access premium features for a limited time (e.g. $1 for 3 days). Trials convert better with warmed-up or intent-based traffic like native, search or push + warming-up pre-landing. They work best in Tier 1 markets where users are comfortable with online payments. The key here is trust — creatives and landings must look premium and reliable.

CC Submit

The user enters payment info for a subscription — no trial period. Used in adult dating or cam traffic where impulse plays a role. Conversions are lower but payout is higher. Traffic must be warmed up with aggressive yet believable angles. Works with pop traffic, adult-themed push, or brand searches.

RevShare (Revenue Share)

With RevShare, the affiliate gets a percentage of what the user spends over time. It’s a long term play: fewer conversions upfront but higher lifetime value. This model is used for cam sites, live chat offers, and premium adult platforms. Best paired with high-quality or retargeting traffic sources and sometimes used by experienced media buyers who are ready to build funnels and retain audiences.

💡 Tip: When choosing a monetization model, always match it to your traffic type, user intent and geo. Push and pops are unbeatable for quick flows like SOI/DOI, while native and search perform better for trials or CC submits.

Best Traffic Sources for Dating Offers in 2026

Dating offers are everywhere — but running them successfully depends heavily on choosing the right traffic source. Formats vary not just by price and volume but by how strict their moderation rules are. In 2026, some platforms have tightened their restrictions especially when it comes to suggestive or adult-leaning creatives. That’s why affiliates continue to turn to push and pop traffic: they offer freedom, volume and flexibility — all at a low price.

Let’s break down the top traffic formats for promoting dating offers and highlight where restrictions apply — and where they don’t.

Push Traffic: Low Entry, No Restrictions, High Volume

Push ads are still the go-to format for dating affiliates — and for good reason. You can launch fast, scale easy and test creatives freely. Unlike social or native channels, most ad networks with push traffic don’t restrict dating or adult angles. This makes it ideal for testing aggressive or flirty creatives without fear of bans.

You don’t need a big budget either — CPCs often start at just $0.003 and targeting options like geo, OS, device, browser help you narrow down your audience fast.

- No creative restrictions

- Great for SOI/DOI offers

- Perfect for Tier 2–3 GEOs with mobile-first users

Popunder (Pop) Traffic: No Restrictions, Maximum Scale

Popunder ads are even more aggressive than push — and they work great for adult dating, cam offers, and sweep-style flows. The user doesn’t need to click — your page just opens. That means high impressions, low CPM and no moderation headaches.

Since most pop ad networks don’t ban dating content, you can test even the boldest creatives, funnels and geo mixes. This is especially powerful for affiliates who need raw volume and fast data.

- Loq ad moderation

- Super low CPM (from $0.5)

- Ideal for Tier 2–3 geo testing

Native Ads: Expensive, Strict, But High Quality

Native advertising can work for mainstream dating offers especially, in Tier 1 markets. But native platforms like Taboola and Outbrain have very strict rules: adult or even suggestive content often gets rejected and creatives must be subtle, emotional and compliant.

Plus, entry prices are high — CPCs from $0.30+ and pre-landings are almost required. Native is better for seasoned affiliates with bigger budgets and clean angles.

- Strict moderation

- Limited to mainstream offers only

- Adult creatives will not pass review

- High cost per click

Social Traffic (Facebook, TikTok): Ban Risk and High CPM

Social platforms can be a strong source if you’re promoting niche or clean dating offers like senior or LGBTQ+ matchmaking. But if you’re planning to buy dating sites traffic on Facebook or TikTok, be ready for challenges. These platforms have strict ad policies — even slightly suggestive creatives can lead to bans.

You also need deep knowledge of cloaking, compliance, and ad psychology to survive. High CPM and CPM fluctuations make it tough to scale affordably.

- High moderation risk

- Bans are common

- CPMs from $8–$20+ depending on geo

Email Traffic: Stable but Requires Access

Email still works, especially for adult dating and mature users. Since you control the creative and landing, restrictions are minimal — but you need access to warmed-up lists. Deliverability and click rate can vary wildly.

Email is good for retargeting or reactivation campaigns, but not ideal as a first-touch channel unless you’re a list owner.

- Moderation-free

- Not scalable without lists

- Medium cost and variable CR

Search & Google PPC: High Intent, But Heavily Regulated

Google is one of the most restrictive platforms for dating. Most adult or casual flows are banned, and even mainstream offers have to be worded carefully. Combined with high CPCs and account risks, it’s not for beginners.

This is for experienced affiliates who know how to build compliant funnels and keep their account healthy.

- Strictest moderation on the list

- No adult content allowed

- CPCs from $0.50–$2+ for competitive keywords

Comparison Table: Dating Traffic Sources at a Glance

| Traffic Source | Best For | Moderation Level | Cost | Volume | Notes |

| Push Ads | Casual, Adult SOI/DOI | 🟢 None/Low | Low | High | Free testing, flexible creatives |

| Popunders | Adult, Casual, Cam flows | 🟢 None | Very Low | Very High | Perfect for aggressive landers |

| Native Ads | Mainstream, Trial, Subscription | 🔴 Strict | High | Medium | Clean only, premium traffic |

| Facebook/TikTok | Niche dating, apps | 🔴 Very strict | Medium–High | Medium | Ban risk, requires whitehat approach |

| Email Traffic | Adult, mature, retention flows | 🟢 None | Medium | Variable | Good CR, limited scale |

| Search PPC | Premium/clean offers | 🔴 Strictest | Very High | Low–Medium | Only for top-tier, compliant campaigns |

💡Key takeaway: If you’re looking for a dating traffic sourcewith no restrictions and low cost, push and pop ads are the way to go. They let you launch fast, test different angles and reach a massive audience without ad policies. That’s why most top performing affiliates still use them as their foundation in 2026.

Now let’s see how ROIads ad network helps you run push and pop traffic at scale — with tools designed specifically for the dating vertical.

ROIads: The Best Traffic Source for Dating Offers in 2026

If you’re looking for a traffic source that’s made for dating — this is it. At ROIads, dating is one of our top verticals and we know exactly what affiliates need to run profitable campaigns: push and pop traffic with no restrictions, low entry points and real tools to scale fast. ROIads gives you full control and the power to optimize every step of the way.

🚀 Key Features for Dating Affiliates:

- Push & pop traffic with no creative restrictions

- Low CPC from $0.003 and CPM from $0.5

- AI bidding technology, Micro bidding, CPA Goal strategy, Optimization Rules to optimize performance

- Premium traffic sources across Tier 1–3 geos

- Minimum deposit just $250 to get started

Ready to scale your dating campaigns? Let us help you launch fast, test smarter, and grow your profits — with traffic that’s actually built for dating.

3 Best Creative Approaches That Drive Clicks on Dating Push Traffic

If you’re going to buy dating traffic and expect results, your creative must do the heavy lifting. Especially with push ads, where you have just a second to catch attention. The best-performing dating creatives in 2026 rely on psychological triggers — they imitate real interactions, provoke curiosity, and create a sense of urgency or familiarity.

Here are three proven approaches that top affiliates use to drive clicks and conversions in dating campaigns on push.

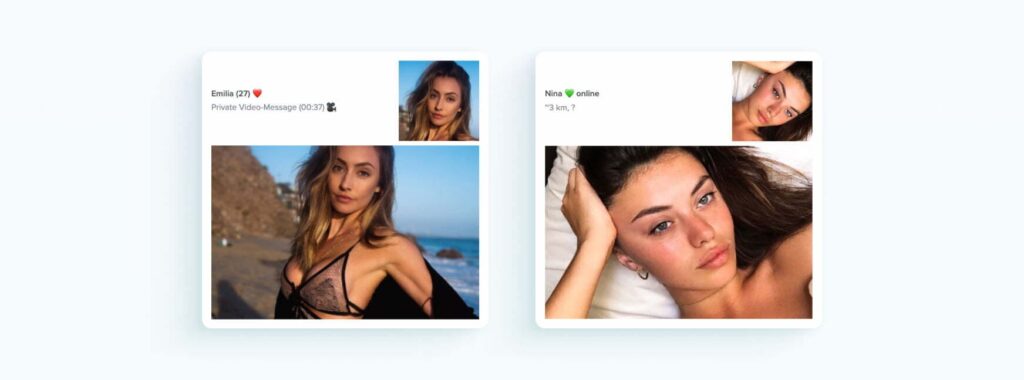

1. Message-Style Profiles from Nearby Girls

This is one of the most timeless angles for dating push traffic — and it still converts like crazy. The idea is simple: show a real-looking woman, relaxed and natural, paired with a short copy that resembles a message or match notification. Something like:

“Nina 💚 online”

“~3 km, ?”

It plays on the user’s expectation of what a dating app message looks like. There’s no aggressive pitch, no clickbait — just something that feels familiar, casual, and potentially real.

Why it works:

- Mimics Tinder/Bumble-style notifications

- Builds trust with simplicity

- Works great for SOI/DOI offers in casual and adult dating flows

- Especially effective on mobile devices in Tier 2–3 geos

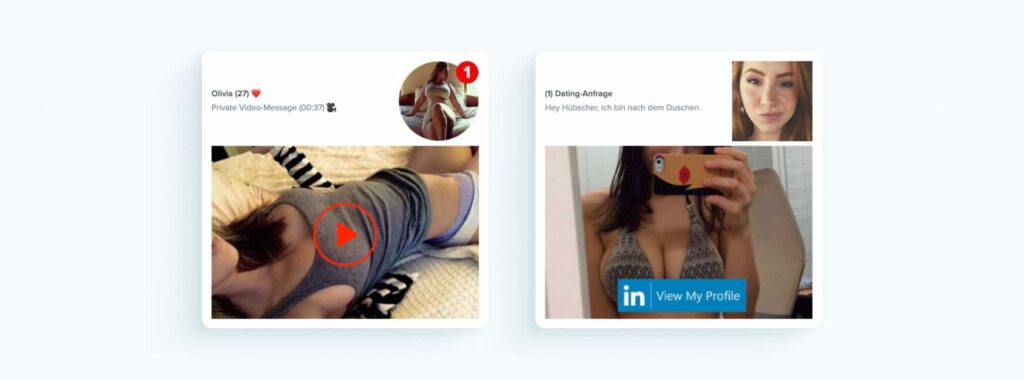

2. Clickable-Looking Creatives with Buttons or CTAs

This approach adds visual triggers — play buttons, “View Profile” CTAs or anything that looks like a user can interact with it. It makes the creative feel dynamic and app-like, even though it’s a static push image.

You’re not just showing content — you’re suggesting that something happens when you click. This tactic works especially well in adult dating or webcam campaigns, where the user expects interaction

Why it works:

- Pushes user to take immediate action

- Mimics video players or profile popups

- Helps creatives stand out in a crowded push feed

- Performs especially well with male audiences aged 25–45

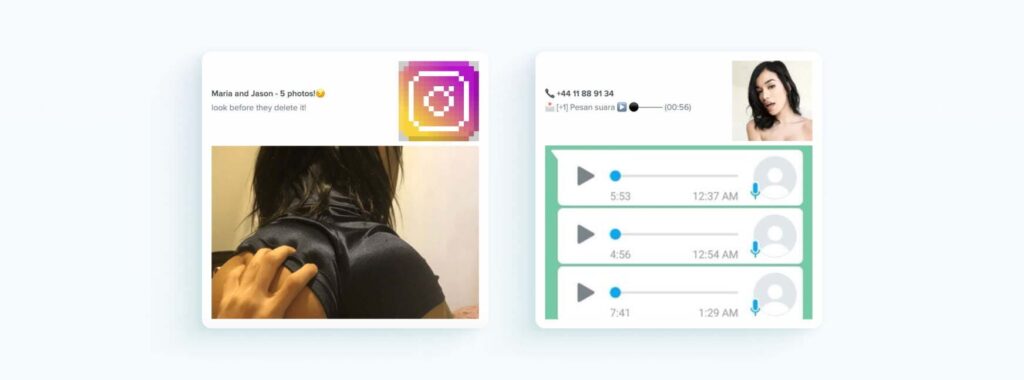

3. Familiar Interfaces and App Logos: WhatsApp, Instagram, LinkedIn

One of the most powerful tactics right now is recreating UI elements from popular apps — WhatsApp voice notes, Instagram story alerts, call screens or even LinkedIn profile messages. When users see a visual cue from an app they use daily, they instinctively pay attention.

Add brand-style logos (even pixelated or modified to avoid moderation), and you get a pattern-recognition effect that triggers reflex clicks. This is perfect for adult dating traffic sources, where engagement happens impulsively.

Why it works:

- Feels native to the user’s phone environment

- High CTR from curiosity and urgency

- Blends naturally into mobile traffic

- Fully allowed on ROIads with no restrictions

✅ Key takeaway for affiliates: Push ads work best when they don’t feel like ads — they look like a native notification on users’ device. Use familiar cues, keep the message short, and make the user feel like they’re about to interact — not just read. All three approaches above are battle-tested for dating traffic and can be launched without limitations.

6 Best Landing Page Strategies for Pop Traffic in Dating Campaigns

Popunder traffic doesn’t rely on banners or icons — it’s all about what users see first when the page opens. In dating affiliate marketing, that means your landing page or pre-landing has to do the entire job of grabbing attention, creating interest, and driving action.

When you buy dating traffic through pops, the page must instantly match the user’s expectations — whether it’s a clean mainstream dating offer or an adult flow. Below are six of the most effective strategies affiliates are using in 2026 to convert pop traffic into profit.

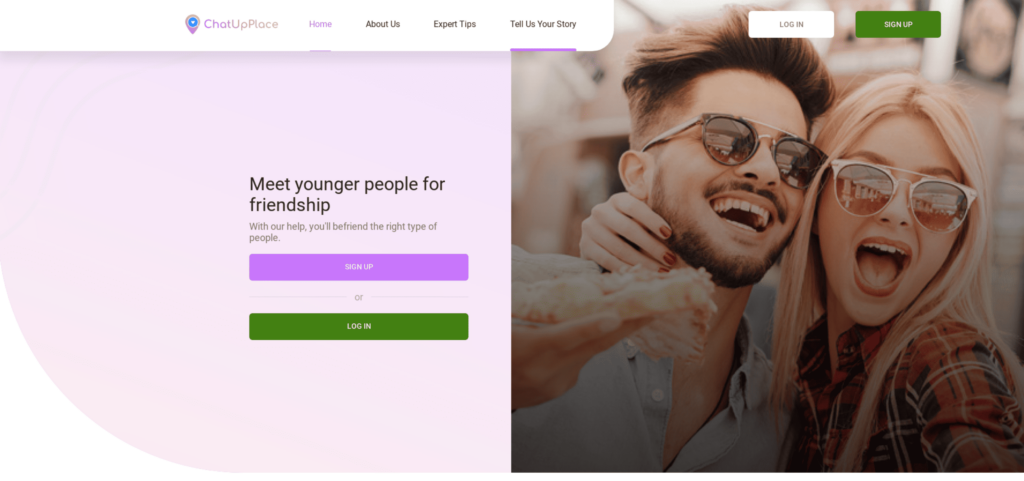

1. Soft Dating Message with Visual Appeal

A light, friendly landing with emotional positioning: “Meet younger people for friendship,” featuring happy people, pastel colors, and no adult triggers.

Why it works:

This kind of dating site traffic landing is perfect for Tier 1 and mainstream audiences. It builds instant trust, feels safe, and works well with SOI or DOI dating offers. The “friendship” angle also bypasses resistance from more cautious users.

- Best for: Mainstream dating, clean traffic, DOI flows

- Works great with: Tier 1–2 geos

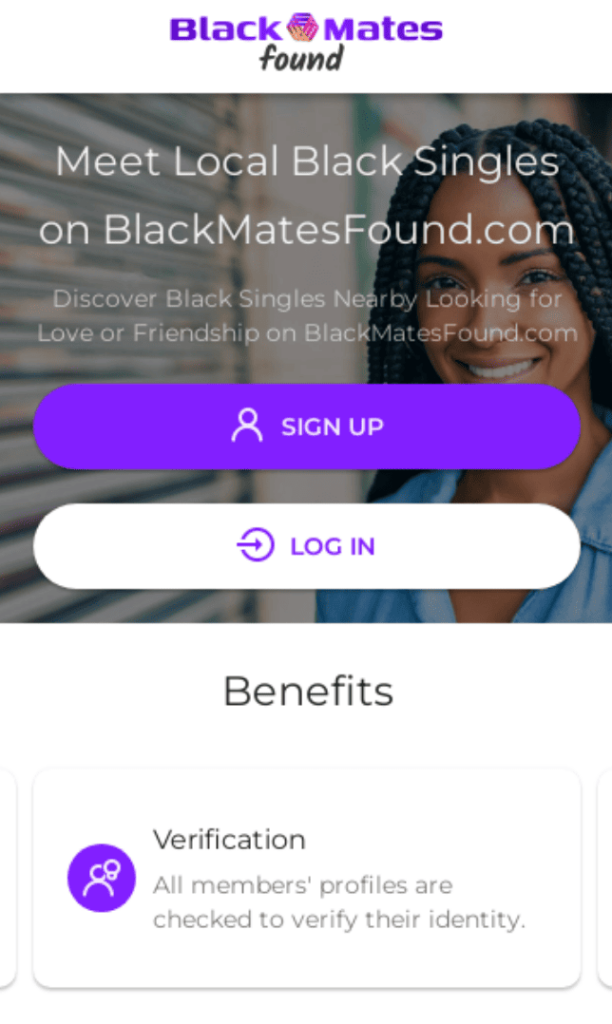

2. Niche-Oriented Landings (Ethnic, Age-Based, LGBTQ+)

The copy directly targets a specific community (in this case, Black singles), combined with an authentic image and credibility-enhancing elements like “Verification” and benefits.

Why it works:

Niche landings match intent — users feel the offer is personally relevant. These landings work better in regions where identity, age or community-based dating is highly contextual. They convert well on dating traffic sources that allow geo and device targeting.

- Best for: Niche dating offers, email submit or trial flows

- Ideal for: Tier 1 geos, urban audience targeting

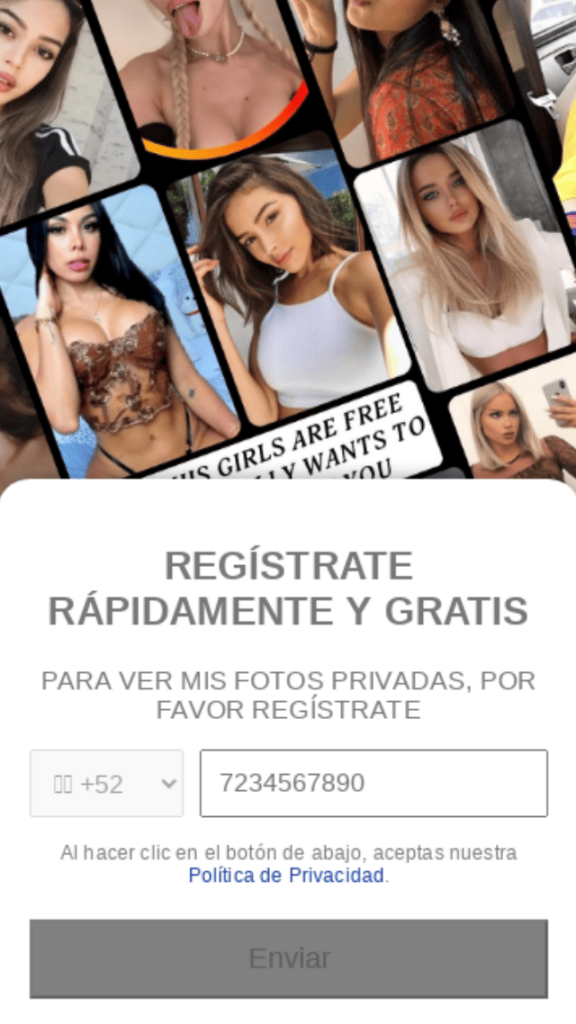

3. Bold Adult Visuals + Direct Signup Prompt

Spanish-language landing with collage of women and “Regístrate rápidamente y gratis” High-energy, visual-heavy landing full of profile images, a bold claim (“These girls are free”), and a mobile-friendly phone number entry form.

Why it works:

This is pure performance — you buy dating traffic and drive it straight to an emotional, lust-driven hook. Users don’t have to scroll or think — they’re told what they’re getting and what to do. Pop traffic is perfect here due to volume and no creative restrictions.

- Best for: Adult SOI flows, international offers

- High CR in: Tier 2–3 markets (LATAM, Southeast Asia)

4. Classic Pre-landing: Age Verification Gate

A clean, dark pre-landing that simply asks the user to confirm their age before proceeding.

Why it works:

Adds just the right amount of friction — enough to pre-qualify users and improve CR on the next step. This flow is widely used in dating ad networks where adult content is allowed. Also, reduces bot traffic and filters out accidental clicks.

- Best for: Adult and cam dating offers

- Pairs well with: Aggressive landers or one-click flows

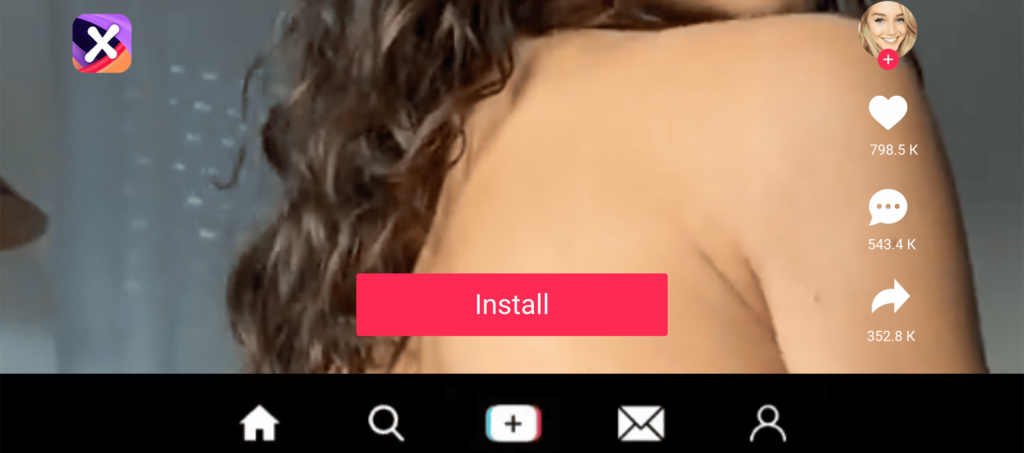

5. Video Background Mimicking TikTok or Reels

The user is dropped into what feels like a social video feed. Design imitates apps like TikTok or Likee, with live background clip, install button and familiar icons.

Why it works:

Uses visual muscle memory — users pause to watch and the layout keeps them engaged. Works great with male audiences 18–34 and performs well with mobile dating traffic sources.

- Best for: App installs, adult offers

- Hot in: Indonesia, Brazil, India, USA

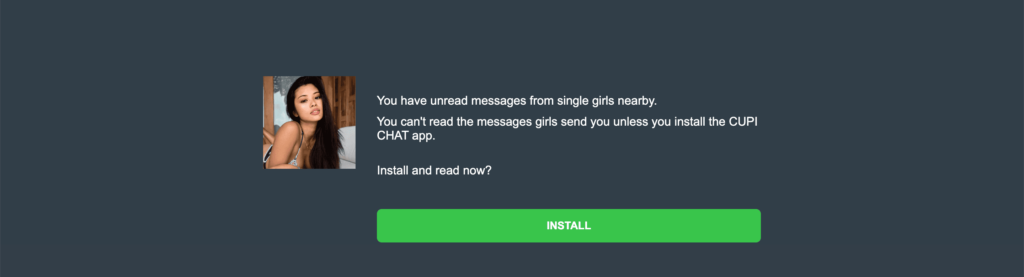

6. Message-Like Popups: “Unread Messages Nearby”

Native-style popup saying user has messages from girls nearby which can only be read after installing the app.

Why it works:

Activates curiosity and FOMO — the two best triggers in dating traffic. Mimics inbox notifications from real dating apps, and installing CTA feels like a natural step. Works best with trusted landing brands and clean installs.

Best for: Mobile flows, cam/chat offers

High CTR on: Pop traffic with Android targeting

✅ Pro Tip for Affiliates: When working with popunder traffic for dating sites, always tailor the landings to your target geo and flow. Casual dating in Tier 1? Go soft and clean. Adult cam offer in Tier 3? Go bold and visual.

Conclusion

Dating is one of the strongest verticals in affiliate marketing — and 2026 brings even more opportunities. With the right strategy and quality dating traffic sources, you can reach a global audience searching for connection, excitement, or something meaningful.

If you’re looking to buy dating traffic that converts, ROIads is your go-to platform. We offer premium push and popunder formats — the perfect match for driving high-quality dating site traffic.

Dating is on fire — now’s the time to launch. Start with ROIads and turn traffic for dating sites into your next big win.