Dating is a top affiliate vertical, with mainstream and adult offers generating billions in revenue. While social and search have restrictions, push and popunder traffic deliver scale, high CTR and easier approvals. With proper targeting, pre-landings and tracking, affiliates can profitably scale dating site ads, especially through ROIads.

Dating advertising is one of the most profitable verticals in affiliate marketing. Year after year, dating offers are in the top 5 niches because they combine huge demand with strong monetization potential. For affiliates, this vertical gives:

- consistent traffic across all geos,

- high CTR compared to many other niches,

- stable payouts and scalable campaigns.

What makes dating ads special is that the demand never disappears — the global online dating market is growing, with billions in yearly revenue and a mobile-first audience ready to engage.

This guide will go through the types of dating adverts, the economics and demographics behind the vertical, the best traffic sources, and practical dating ads examples. We’ll also look at why not all options for promoting dating are suitable and find out which ones are the most effective. And how ROIads can help you scale dating site ads profitably.

Roya, Emotional Damage Officer & Supreme AI Arbitragist at ROIads

Check out our full, practical guide on the dating vertical — lots of useful insights inside:

What Is Dating Advertising: Types of Dating Offers

Dating advertising means promoting online dating services, platforms or apps through paid campaigns. For affiliates, dating offers are one of the most stable and profitable verticals because the demand for communication, relationships and connections is global and evergreen.

The dating vertical is generally divided into two categories:

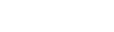

Mainstream dating

- Targeted at a wide audience looking for chatting, friendships, casual dating or long-term relationships.

- Safer to promote on platforms with stricter moderation policies.

- Dating adverts usually highlight positive emotions, lifestyle visuals and relatable scenarios.

Adult dating

- 18+ content with explicit elements.

- Higher CTR and conversions but you need to choose the right traffic sources and networks that allow this type of promotion.

- Dating ads examples here use direct messaging, stronger CTA and bold creatives.

Both can generate good leads and conversions if combined with proper targeting and optimization. Affiliates test both mainstream and adult dating offers to find the balance between traffic scale and approval restrictions.

Economic & Demographic Features of the Dating Vertical

The dating advertising vertical is backed by one of the fastest-growing digital markets. For affiliates, this means a constant supply of profitable dating offers and scalable dating traffic worldwide.

Market Size and Growth

- According to the data from Precedence Research, the global online dating services market was valued at $5.22 billion in 2024 and is projected to reach $6.09 billion in 2026

- The dating app industry alone generated over $6 billion in revenue in 2024, growing 15.7% year-on-year, with the user base reaching about 360 million people, Global Dating Insights says.

Demographic Trends

- Age and adoption: Gen Z and Millennials dominate dating site ads engagement, but growth is accelerating in the 45–65+ demographic.

- On Tinder, the user base is heavily skewed by gender: 75.8% male vs 24.2% female, and age distribution shows 35.7% are 18–24, 25.5% are 25–34, 20.4% are 35–44, 8.2% are 45–54, and 10.2% are 55+.

- By country, China 🇨🇳 leads in sheer user numbers, with about 82.8 million dating app users in 2026, followed by the U.S. 🇺🇸 at 60.5 million.

Key Metrics Overview

| Metric | Value / Trend |

| Market Size (2026) | $6.09B |

| Forecast (2030–2032) | $13.14B – $17.29B |

| CAGR | 5.8% – 7.5% |

| Users (2026) | 360M+ globally |

| Revenue (2026) | $6.18B from apps, Match Group $3.5B share |

| Mobile Share | ~80% of usage comes from mobile apps |

| Growth Regions | North America (strongest), Asia-Pacific (fastest-growing) |

| Demographic Notes | Gen Z: lower spending but high engagement; 45–65+ segment expanding |

What This Means for Affiliates

For affiliates running dating ads campaigns:

- Mobile-first optimization is a key — most conversions come from smartphones.

- Dating traffic is diverse: younger audiences convert with free-trial or freemium models, while older users show higher paid subscription rates.

- Creative positioning should adapt: value-driven messaging works for Gen Z, while straightforward relationship-focused dating adverts resonate with older demographics.

- Niche dating offers (LGBTQ+, religious, senior dating) are gaining traction, giving affiliates new angles for high CTR and strong ROI.

Top Traffic Sources for Dating Promotion

Choosing the right traffic source is crucial for profitable dating advertising. While every channel has potential, affiliates must carefully consider restrictions, compliance policies and the risks tied to promoting adult dating offers.

1. Social Media Ads

Social platforms are the most attractive channels for dating ads due to their advanced targeting. But they also have the strictest policies. Adult dating adverts are almost always disapproved and even mainstream campaigns risk getting banned if creatives are too aggressive.

- Platforms: Facebook, TikTok, Snapchat, Instagram

- Pros: Targeting; high-quality leads; scalable for mainstream dating offers

- Cons: Strict moderation; high risk of account suspension; adult dating ads almost impossible to approve

- Use case: Usually safe for mainstream dating site ads, but not for adult traffic

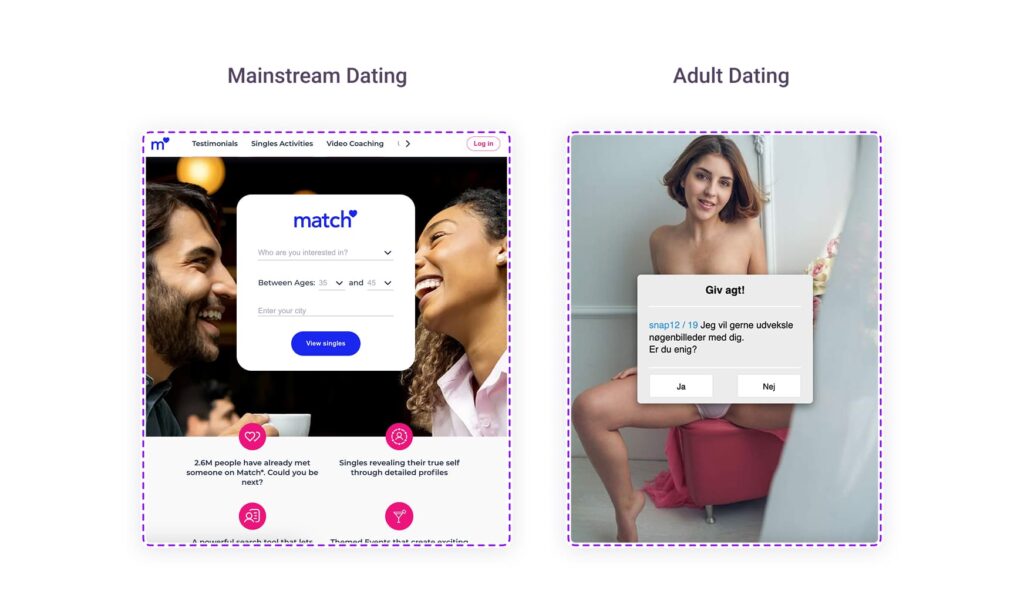

2. Native Ads

Native platforms are more flexible than social media, allowing affiliates to run dating adverts through content-style ads. But networks often reject explicit creatives, so affiliates have to use softer angles and storytelling.

- Platforms: Taboola, Outbrain, MGID

- Pros: Engagement through content; credibility through contextual placement

- Cons: High creative effort (pre-landers, long-form funnels); adult ads get rejected frequently

- Use case: Good for mainstream dating advertising, but compliance limits adult offers

3. Search & SEO

Search traffic can deliver the highest-intent clicks for dating ads, as users are actively looking for dating sites or apps. But the restrictions here are extreme: adult keywords are heavily penalized and many search engines block entire categories of adult dating offers. For SEO, websites in the adult niche face high risks: de-indexing, ranking penalties and domain bans.

- Platforms: Google Ads, Bing Ads, SEO-optimized landing pages

- Pros: High-intent traffic; good conversion rates on compliant campaigns

- Cons: Almost impossible to run adult dating adverts; SEO for adult sites carries long-term risks (penalties, bans, loss of rankings)

- Use case: Only viable for mainstream dating site ads in compliant geos

4. Email Marketing

Email is one of the safest channels for dating offers, but compliance depends on list quality and content type. Mainstream newsletters usually pass without issues, but adult content risks spam flags and deliverability problems.

- Pros: High engagement, good for warm leads, customizable messaging

- Cons: Quality lists, scaling limited, adult campaigns end up in spam folders

- Use case: Retention and reactivation in mainstream dating campaigns

5. Push Notifications

Push ads are one of the least restricted formats in dating traffic. They show up as clickable system-style alerts on mobile or desktop, so they work for both mainstream and adult offers. While moderation rules apply, push platforms are more lenient with adult creatives than social or search.

- Pros: Mobile-first, high CTR, scalable across geos, fewer restrictions than social/search

- Cons: Creative fatigue requires refresh; still limited by network policies in Tier-1

- Use case: Mainstream and adult dating advertising, Tier-2 and Tier-3 markets

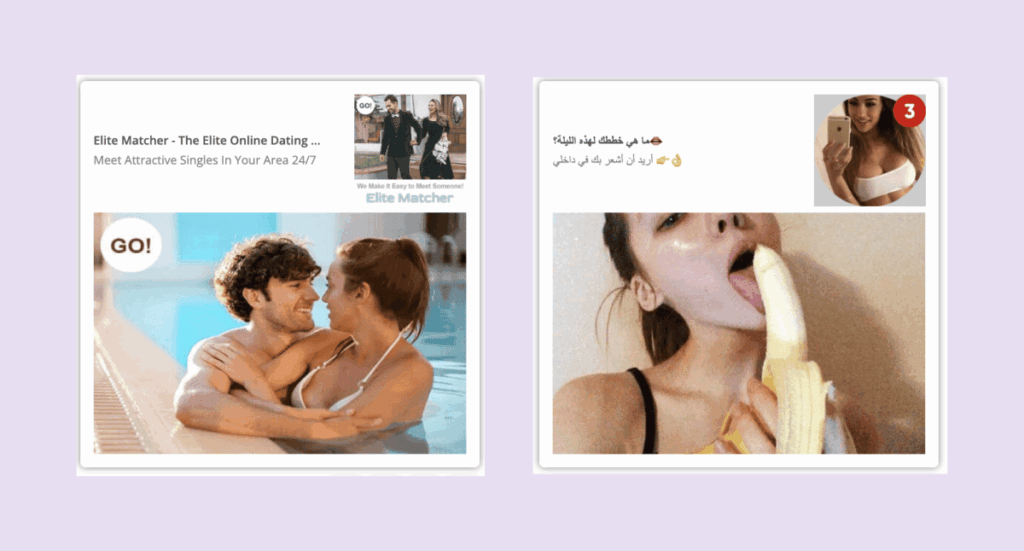

6. Popups / Popunder (OnClick Traffic)

Popunder ads are one of the most open channels for dating adverts. They guarantee visibility and allow aggressive promotion styles, so they’re perfect for mainstream and adult campaigns. While quality varies and optimization is needed, pops are one of the safest options for affiliates who want to avoid heavy restrictions.

- Pros: Huge scale, instant exposure, fewer restrictions than social, native, or search

- Cons: Traffic quality varies, needs filtering, optimization and frequency capping

- Use case: Adult dating site ads and large-scale testing of mainstream dating offers

Why Pops and Push Work Best for Dating Traffic

After reviewing all traffic channels, it’s clear why affiliates go for push notifications and popunder ads when running dating advertising campaigns. Unlike social or search, where adult dating adverts are heavily restricted, push and pops offer scale, flexibility and fewer compliance hurdles. Also they are usually cheaper than other traffic sources. CPC for push ads starts from $0.003, while CPM for pop ads — from $0,5.

Push Notifications: High CTR with Lower Restrictions

Push ads look like native mobile alerts, delivering short, engaging messages directly to a user’s device. For dating ads examples, this format is super effective — users see the message as personal and click almost instantly.

- High engagement: Dating creatives on push get above average CTR compared to banners or native ads.

- Mobile-first: 80% of dating traffic is on mobile, so push is a no-brainer.

- Moderation flexibility: Adult dating adverts often pass where social ads would be blocked.

- Retargeting power: Push is good for re-engaging warm leads, increasing conversions and ROI.

Popunder Ads: Massive Volume with Minimal Barriers

Pop (popunder and popup) ads guarantee exposure by opening a landing page behind in front the active window or browser. For dating site ads, this means the offer always gets seen. Affiliates choose pops because they combine aggressive visibility with very few restrictions.

- Huge traffic volume: Pops deliver one of the biggest volumes of dating traffic.

- Fast testing: Perfect for A/B testing new dating offers across multiple geos.

- Lower compliance pressure: Unlike search and social, pop traffic accepts adult dating ads, so affiliates have more creative freedom.

- Low entry point: CPMs are often lower than native or search campaigns, ideal for testing.

ROIads: The Best Network for Dating Ads

For affiliates ready to scale dating offers, choosing the right ad network is critical. ROIads ad network is a top choice because it focuses on the four formats that work best for dating traffic: push, pops, in-page push, direct click.

- Optimization tools: AI bidding technology, CPA Goal, Optimization Rules, and Micro bidding for source-level adjustments.

- Transparent reporting: Easy to identify which placements deliver the best CTR and conversions.

- Global coverage: Only premium traffic across 150+ geos with high-quality dating traffic sources.

- Affiliate support: Personal managers and ready-to-use dating ads examples and creatives help new campaigns scale faster.

With ROIads, affiliates don’t have to fight endless restrictions. Instead, they can focus on testing creatives, optimizing campaigns, and scaling dating site ads to real profit.

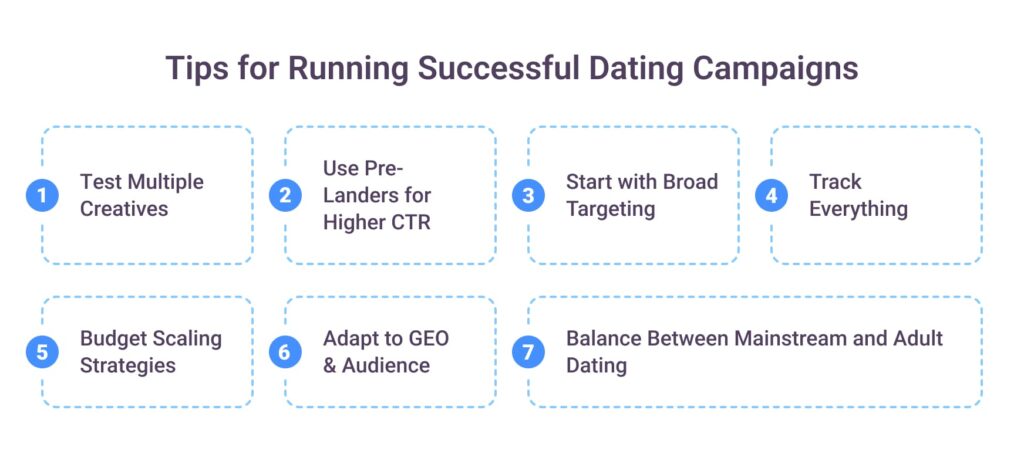

Tips for Running Successful Dating Campaigns

Running dating ads is not just about sending traffic — it’s about optimizing every step of the funnel. Below is a proven checklist affiliates can follow to maximize ROI from dating offers.

1. Test Multiple Creatives

One creative is not a test. Media buyers should launch at least 5–10 dating ads examples to compare CTR and conversions. Push and pop traffic respond well to variations in:

- Headlines (questions, curiosity, FOMO)

- Images (attractive models, couples, lifestyle scenes)

- Call-to-action buttons

Pro tip: Refresh creatives every 7–10 days to avoid banner blindness, especially on push.

2. Use Pre-Landers for Higher CTR

Sending users directly to a dating site often underperforms. Pre-landings “warm up” visitors before the final conversion.

- Boost engagement and clicks to the main offer page

- Allow advertisers to pre-qualify traffic (age, intent, interest)

- Increase CTR and lead-to-conversion ratio

3. Start with Broad Targeting

Over-segmentation kills volume. Begin campaigns with broad targeting (geo + device), then optimize step-by-step.

- Analyze by OS, browser, carrier, site/source

- Apply Micro bidding or blacklists to cut underperforming traffic

- Use retargeting to re-capture users who clicked but didn’t convert

4. Track Everything

Without tracking, you’re flying blind. Affiliates should monitor these metrics through the postback tracking:

- CTR (click-through rate of dating adverts)

- CR (conversion rate of landing pages)

- EPC (earnings per click)

- Leads and final ROI

Pro tip: Use trackers integrated with networks like ROIads to simplify campaign optimization.

5. Budget Scaling Strategies

- Start small: $30–$50 per day to collect initial data

- Increase gradually: Scale profitable sources 20–30% per day

- Whitelist & blacklist: Build whitelists of high-performing placements, blacklist poor-quality ones

- Retargeting: Reinvest in warm leads — often cheaper and more profitable than cold traffic

6. Adapt to Geo & Audience

Different geos = different behavior. For example:

- Tier-1 markets (US, UK, CA): higher payouts, but stricter moderation and competition

- Tier-2/3 markets (LATAM, SEA, Eastern Europe): cheaper traffic, easier approvals, faster testing

Creatives must match culture and audience expectations. A dating ad that works in the US may not work in Indonesia. Also you should adapt and localize creatives and ad copies in each geo.

7. Balance Between Mainstream and Adult Dating

- Mainstream dating site ads: Easier approval, more long-term stability

- Adult dating ads: Higher CTR and conversions, but require tolerant traffic sources (push/pops)

Smart affiliates run both, split traffic to diversify results. With these tips, affiliates can build strong, scalable dating ads while avoiding the most common mistakes.

Quick Dating Campaign Checklist

| Step | Why It Matters |

| Test 5–10 dating adverts | Find the best CTR and conversions |

| Use pre-landings | Warm up users and boost engagement |

| Start broad, then optimize | Maintain volume before filtering traffic |

| Track CTR, CR, EPC, leads | Data-driven decisions only |

| Scale gradually | Avoid burning budgets and losing control |

| Geo & cultural adaptation | Improve relevance and conversions |

| Mix mainstream & adult | Balance scale with profitability |

With these strategies, affiliates can build strong, scalable dating ads campaigns while avoiding the most common beginner mistakes.

Final Thoughts: Why Now Is the Best Time to Scale Dating Ads

The global dating advertising market is not slowing down. With billions in annual revenue, hundreds of millions of active users, and a mobile-first audience that keeps growing, dating offers are one of the most stable verticals for affiliates.

But success doesn’t come from picking the right offer alone — it’s about choosing the right traffic sources and network. As we’ve seen, channels like social or search are full of restrictions, making it almost impossible to run adult dating adverts at scale. Native and email can complement your funnel, but the real power lies in push notifications and popunder traffic, where CTR, conversions and scalability meet.

This is where ROIads delivers an edge. With push and pops at the core, advanced targeting, AI bidding, CPA Goal and transparent reporting, affiliates can focus on optimization instead of fighting restrictions. Whether you’re running mainstream dating site ads or testing adult dating ads examples, ROIads provides the traffic quality and tools to scale profitably.

The opportunity is clear:

- Global demand for dating is rising

- Mobile-first audiences are ready to click and convert

- Affiliates with the right network can turn clicks into long-term revenue

👉 If you’ve been waiting for the right moment to jump into dating campaigns, now is the time. Launch your next dating ads campaign with ROIads advertising network today and get into one of the most profitable verticals in affiliate marketing.

FAQ: Dating Ads Guide 2026

❓What are dating ads?

Dating ads are online advertisements that promote dating websites, mobile apps, or related services. They are used by affiliate marketers to drive traffic and generate sign-ups, subscriptions, or in-app purchases. Dating ads typically appear in formats like push notifications, popunder ads, native ads, and social campaigns.

❓Are dating ads profitable in 2026?

Yes, dating ads remain highly profitable in 2026. The dating app industry generated over $6 billion in 2024 and continues to grow. Affiliates who use the right traffic sources, optimized creatives, and strong pre-landers can achieve high ROI, especially in Tier-2 and Tier-3 markets where competition is lower and approval is easier.

❓Which countries are best for dating traffic?

Top geos for dating traffic in 2026 include the United States, United Kingdom, and Canada (high payouts but high competition), as well as Tier-2 and Tier-3 regions such as Latin America, Southeast Asia, and Eastern Europe. Countries like Brazil, Indonesia, and India are especially strong for dating ads due to large audiences and lower traffic costs.

❓What are the best dating ad networks?

The best ad networks for dating offers are those with large volumes of push and pop traffic, smart optimization tools, and global reach. Recommended networks include ROIads, RichAds, Evadav, and PropellerAds, all of which specialize in formats like push and pop ads that work well for dating.

❓How do I promote dating offers with paid ads?

To promote dating offers with paid ads, affiliates usually:

- Choose a traffic source (push or pop networks).

- Test 5–10 creatives with different headlines and images.

- Use pre-landers to warm up users before the main offer.

- Start with broad targeting and optimize by device, OS, or source.

- Track CTR, CR, EPC, and ROI to scale profitable campaigns.

❓Which ad formats work best for dating (push, pop, native)?

Push and pop ads are the most effective formats for dating in 2026. Push notifications generate high CTR with engaging headlines and images, while popunder ads deliver massive traffic volume at low cost. Native ads can also perform well for mainstream dating but require higher budgets and more creative effort.

Roya, Emotional Damage Officer & Supreme AI Arbitragist at ROIads